By: ThinkBusiness Africa

Chinese lending to Africa has plummeted to a near-historic low of $2.1 billion in 2024, marking a 46% year-on-year decline and signaling a fundamental shift in Beijing’s economic strategy on the continent.

According to a report released Wednesday by the Boston University Global Development Policy (GDP) Center, the “megaproject era” of the Belt and Road Initiative (BRI) has officially given way to a new phase of “selective, strategic engagement.”

At its height in 2016, Chinese loan commitments to African nations peaked at $28.8 billion. The 2024 figure represents less than 8% of that volume. This sharp contraction follows a brief post-pandemic rebound in 2023.

Between 2011-2018 Chinese loans to Africa averaged $9 billion; however post-pandemic struggles caused countries like Zambia, Ethiopia, and Ghana to default on their loans. Beijing found itself taking losses on some of the loans. The report showed.

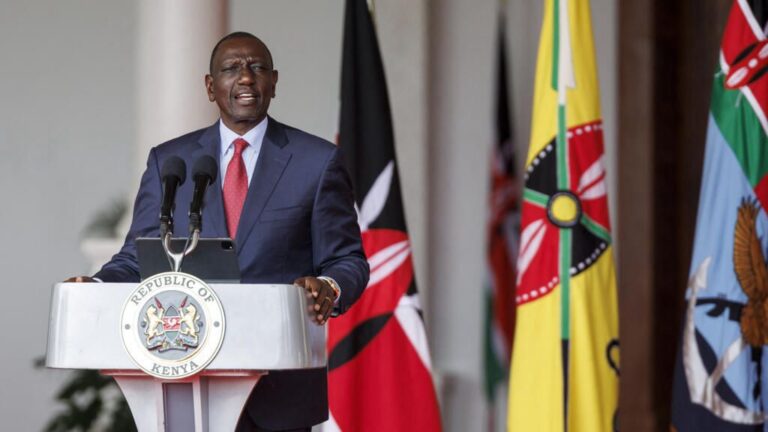

With interest payments consuming more than 25% of government revenues in major economies like Kenya and Angola, Beijing is pivotally shifting its risk management strategy.

The 2024 data highlights a trend toward smaller, commercially viable projects that align with the “Small and Beautiful” directive championed by President Xi Jinping.

In 2024, Chinese lenders backed only six projects across just five countries: Angola, Kenya, the Democratic Republic of the Congo (DRC), Senegal, and Egypt.

Financing was exclusively channeled into resilient sectors: with $1.2 billion for road and transport infrastructure in the DRC, Kenya, and Angola. And $760 million electricity transmission lines in Angola.

“Fossil fuel projects, energy generation and information and communication technology (ICT) stopped receiving additional loans in 2024,” the report noted.

Perhaps the most significant finding in the report is the aggressive move toward yuan-denominated loans, a direct challenge to the dominance of the U.S. dollar in sovereign debt.

In 2024, Kenya converted approximately $3.5 billion of its existing Chinese debt into yuan. This “de-dollarization” strategy aims to shield African economies from U.S. dollar fluctuations while lowering interest costs.

For China, it integrates African markets more deeply into its own financial ecosystem.

Angola emerged as the top recipient in 2024, securing $1.45 billion for power grid and road upgrades. This concentration of funds reflects Beijing’s desire to double down on established, strategic partnerships that involve critical resources and reliable repayment histories.

Analysts at Boston University suggest this decline is not a sign of Chinese withdrawal, but of maturation. By focusing on “on-lending” through local banks and prioritizing energy transmission over massive dams, China is reducing its direct exposure to sovereign defaults while still maintaining influence in core sectors.

However, the $2.1 billion figure leaves a massive infrastructure financing gap for the continent.