Agama to shrink “time to market” for firms after Senate confirmation – Ogho Okiti

After his Senate confirmation yesterday, the Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, has set his eyes on shrinking the time it takes for companies to access the market for different forms of capital. The priority to shrink the time to market follows the frustration of many market stakeholders during the regime of Lamido Yuguda where the time to market sometimes extended beyond 12 months. Agama’s priority, according to sources to him is to seek to conclude the process in 14 days. Dr. Agama was confirmed as DG SEC by the Senate Committee on Capital Markets, chaired by Senator Osita Izunaso. The committee also cleared the nominations of Frana Chukwuogor as Executive Commissioner (legal and enforcement), Bola Ajomale as Executive Commissioner (Operations), and Samiya Usman as Executive Commissioner (Corporate Services). They were all nominated April 19 by President Bola Ahmed Tinubu who is seeking the cooperation of the capital market for his US $1 trillion economy. In addition to shrinking the “time to market”, Agama is also set to establish very strong market rules to not only ensure minimal infraction but also deal with any form of infraction. According to sources, “the SEC must not only ensure that market players follow the rules of the market, but also that there are in no doubt that any infraction will be punished.” That is the only way to strengthen the market, the source added. The third leg of his priority is capital market education. The view here is that gross ignorance of how the market works is not a catalyst for strong capital market growth. To speed up the time it takes for companies to access the market, Agama plans to establish an advisory and business relations office in the SEC. The purpose of the business relations office is to offer prior screening of every proposed offer to ensure that it meets existing rules and regulations of the capital market regulator. Prior experience has shown that one of the delays come from gaps in the applications to SEC and the back and forth on these gaps often mean that companies lose out on access to cheap capital on offer at the capital market. The prescreening process by experts at the business relations office will thus be a great welcome by market participants. The confirmation of Dr. Agama means that this the first substantive DG of the SEC to emerge from within the organization since Mounir Gwarzo in 2017. Until his appointment by the President, Agama was the Managing Director of the Nigerian Capital Market Institute (NCMI), a subsidiary of the SEC. Before then, he was the head of Registration, Exchanges, and Market Infrastructure and Innovation, one of the strongest and key departments at the commission. In addition to top level management in SEC, Agama was a secondee to the US Securities and Exchange in 2018 after completing an 18-month programme in capital market at the George Washington University in the US. The SEC thus have at the helm this time a stockbroker, an accountant, an economist, after receiving his Ph.D. in economics, with distinction, from Nile University of Nigeria after submitting a dissertation on the links between cryptocurrency operations and macroeconomic variables in Nigeria.

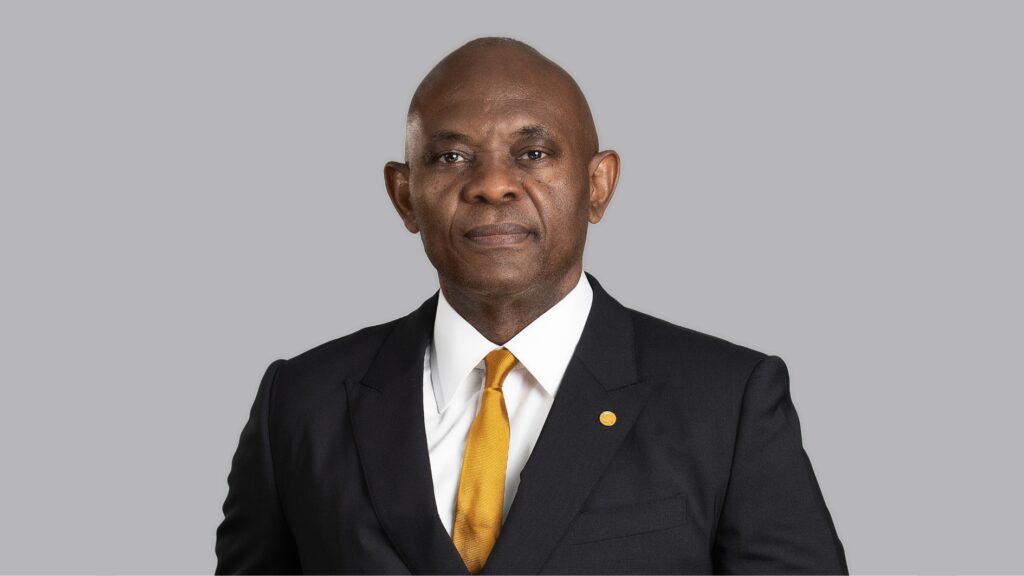

Highlights from Our 62nd Annual General Meeting in Abuja: A Memorable Event for Our Bank

Good Evening and Happy Sunday! Last Friday in Abuja, we celebrated our 62nd Annual General Meeting. Read more about the event and view exclusive photos in today’s newspaper feature. A Promise Fulfilled: UBA Shareholders Commend 2023 Superlative Performance, Dividend Payout ….Shareholders Give Approval to recapitalize as Directed by the Regulators….UBA Pays Total Dividend of N95.8bn, translating to N2.80 per share in 2023. Shareholders of Africa’s Global Bank, United Bank for Africa (UBA) Plc, have praised the board, management and staff of the Bank on the impressive performance recorded over the past years and especially in 2023, culminating in the payout of N78.7bn as final dividend for the 2023 financial year. The shareholders took turns to express their delight during the bank’s 62nd Annual General Meeting which was held at the Congress Hall of Transcorp Hotels in Abuja on Friday. The shareholders overwhelmingly approved the Board of Director’s proposal to raise additional capital through the issuance of securities comprising ordinary shares, preference shares, convertible and/or non-convertible notes, bonds or any other instruments in the Nigerian and/or international capital market. Addressing shareholders at the event, the Group Chairman, Mr. Tony Elumelu, appealed to shareholders to participate fully and re-invest their dividends in the bank’s recapitalisation drive as this will ensure that they continue to enjoy even higher returns from their investments. He said, “I call on you shareholders to re-invest a substantial part of your dividends in our rights issues which will be announced soon, as we will be giving you the first opportunity to own a share in all the countries where we operate, I am advising shareholders, as you get your dividends, reinvest a significant part of it. As for my board members and I, we would be investing 100% of the dividends we get, because If we don’t do so, it means we would be leaving food on the table for others who did not labour for it,” Elumelu stated. In the year under consideration, UBA had declared an interim dividend of N17.1bn representing a pay-out of 50kobo per share for the first half of 2023, thus bringing the total dividend for the 2023 financial year to N95.8bn, representing N2.80 per share. Surprisingly and in another first, dividend payouts were received while the meeting was still on just seconds after the resolution on dividend payments were passed at the meeting by the shareholders, resulting in open excitement from the shareholders. They also commended the bank’s management over the impressive performance for the 2023 financial year, which resulted in the large payout of dividend to its investors, and highlighted its thriving business in its African subsidiaries, which continues to contribute significantly to the Group’s total income. Alhaji Mukhtar Mukhtar, one of the shareholders who spoke at the meeting, commended the Group Chairman, Tony Elumelu, and the Group Managing Director, Oliver Alawuba, for their concerted effort towards ensuring that the performance of the bank reached unprecedented heights in the year under consideration. He said, “I want to specially commend the management and Board of UBA, especially the Chairman, Tony Elumelu and the GMD/CEO, Oliver Alawuba, who have been managing activities of this great institution over the past few years. “We are impressed at the results that you have recorded so far, how you have managed to maintain a well-structured balance-sheet and diversified balance sheet with total Assets growing to over N20trn. The achievement that the bank has recorded under your leadership, especially the sterling contributions of our subsidiaries in Africa deserves accolades,” Muktar stated. Another shareholder, Patrick Ajudo, also commended Elumelu for keeping the promise made to shareholders a few years ago to begin to pay increased dividend. “Our Chairman, Tony Elumelu, promised shareholders a few years ago in this same hall, that he will move from ‘kobo-kobo’ dividends to naira dividends, and he has kept that promise. We are very excited, because, not only have you kept that promise, but you have backed it up by even matching the industry standards. Indeed, we are proud to be associated with such a brand that has integrity, and we highly commend you for this,” he stated. Barrister (Mrs) Adetutu Siyanbola, another shareholder, took time to commend the bank’s management for its operations over the decades, especially as it celebrates its landmark 75th year anniversary, praising the gender balance and high female representation on the bank’s board, which according to her, is a feat worth emulating by other financial institutions in Africa. While commending the GMD for wining several awards in the 2023 financial year, she expressed satisfaction that the bank did not incur any penalty in the year under consideration, which meant that UBA had zero infractions and didn’t run foul of any regulations. At the end of the 2023 financial year, UBA recorded an impressive leap in gross earnings, as it grew from N853.2 billion recorded at the end of 2022 to close at N2.07tn; representing a strong 143 percent growth; total assets also rose remarkably by 90.22 percent, to close at N20.65 trillion up from N10.86 trillion in 2022. Profit before tax, also grew exponentially by 277 percent, to close at N758billion, up from N200.88 billion recorded in 2022; while profit after tax (PAT) grew by 257 percent from N170.2 billion in 2022, to N607 billion. The Group Managing Director/CEO, Mr. Oliver Alawuba, explained that despite being a year of significant geopolitical and economic challenges, UBA’s strength, the effort and dedication of the team, and its leadership in strategic areas such as innovation and sustainability, helped the bank to grow in a profitable and sustainable manner, Looking ahead, he said, “The outlook is great because we are diversified. Our African subsidiaries contributed over 55% to the bank’s profit this year, and we will do more. Already, the Bank entered 2024 from a position of strength, with proven resiliency, a powerful brand and a strong capital position. “As we begin 2024, “execution” will continue to be on the front burner, with an unrelenting focus on market leadership and excellent customer

Transcorp Group Demonstrates Robust Growth in FY 2023; Revenue Increases By 47.3%, PBT by 93.5%. (Lagos, March 31, 2024)

Transnational Corporation Plc (“Transcorp” or the “Group”), Nigeria’s leading listed conglomerate, announces its financial results for the year ended December 31, 2023. The Group achieved substantial growth in its financial indicators, reinforcing its market leadership and strategic positioning. In its audited results, Transcorp reported significant year-on-year growth, with revenue rising to N197 billion in the year 2023, from N134 billion in 2022, representing a 47.3% increase. The strong performance is further demonstration of the Group’s strategic focus and effective execution. Highlights of Transcorp group Results: In response to the results, Dr. (Mrs) Owen D. Omogiafo, President/Group Chief Executive Officer of Transcorp, commented, “The financial results for 2023 underscore our Group’s strong operational performance and the results of our strategic initiatives. Notwithstanding the strong macroeconomic headwinds in the year, we achieved significant growth in revenue and profits, indicating our ability to navigate a dynamic market landscape effectively. Our primary objectives remain centered on achieving sustainable growth, enhanced operational and technical efficiency, and maximizing value for shareholders.” Transcorp is dedicated to its transformation agenda, emphasizing sustained growth and a relentless pursuit of long-term value for shareholders. About Transnational Corporation Transnational Corporation Plc (Transcorp Group) is one of Africa’s leading, listed Conglomerates, with strategic investments in the power, hospitality, and energy sectors, driven by its mission to improve lives and transform Africa. Transcorp’s power businesses, Transcorp Power Plc and Transafam Power, provide over 15% of Nigeria’s installed power capacity. Transcorp is committed to developing Nigeria’s domestic energy value chain, through its investments in OPL281. The Group’s hospitality business, Transcorp Hotels Plc owns the iconic Transcorp Hilton Abuja, Nigeria’s flagship hospitality destination, and has launched the digital platform Aura by Transcorp Hotels.

Transcorp Hotels Plc Delivers Strong Performance in 2023 (…With 36% Year-on-Year Revenue Growth).

Transcorp Hotels Plc (“Transcorp Hotels” or the “Company”), the listed hospitality subsidiary of Transnational Corporation Plc (“Transcorp Group”) has released its audited 2023 full-year results, showing outstanding performance and setting new revenue and profit records. In its full year audited results filed with the Nigerian Exchange (NGX), Transcorp Hotels reported a record-breaking revenue of N41.5 billion in 2023, compared to N30.4 billion in 2022, marking a substantial 36% growth year-on-year, while operating income also grew by 50%, to close at N13.1 billion as of December 2023, compared to N8.8 billion in December 2022. HIGHLIGHTS OF THE RESULT: Dupe Olusola, Managing Director/CEO commenting on the results stated that the Company’s exceptional performance was achieved through continued dedication to excellence, unparalleled guest satisfaction and a resilient spirit that defines its commitment to delivering exceptional service and stakeholder value. “By strategically investing in innovations, that align with our growth objectives, we continue to deliver these impressive numbers, beating our previous year’s records. Our considerable investment in our iconic Transcorp Hilton Abuja have been rewarded by significant increases in occupancy rates and guest satisfaction. We are continuing this investment, with our 5,000-capacity event centre purpose-built to host local and international entertainment, conference, and exhibition events. This new world-class facility located within the premises of Transcorp Hilton Abuja is scheduled to open in the second half of 2024. I am immensely proud of the team’s dedication, resilience, and unwavering commitment to excellence, in providing an unparalleled hospitality experience. We remain focused in our mission to continue exceeding expectations and setting new benchmarks in the African hospitality industry. About Transcorp Hotels Plc: Transcorp Hotels Plc is the hospitality subsidiary of Transnational Corporation Plc (Transcorp Group), one of Africa’s leading, listed conglomerates, with strategic investments in the power, hospitality, and energy sectors, driven by its mission to improve lives and transform Africa. Transcorp Hotels Plc. is consistently reshaping the hospitality landscape in Africa, aligning with its mission to lead and contribute to Nigeria’s growth while positively impacting lives.