The ongoing ownership dispute involving Emerging Markets Telecommunication Service (EMTS), the operator of 9Mobile, has intensified with Keystone Bank’s recent move to join the legal proceedings. The Federal High Court in Abuja resumed hearing the case involving plaintiff Abubakar Funtua against defendants including General Theophilus Danjuma (retd) and his company, LH Telecommunication Limited.

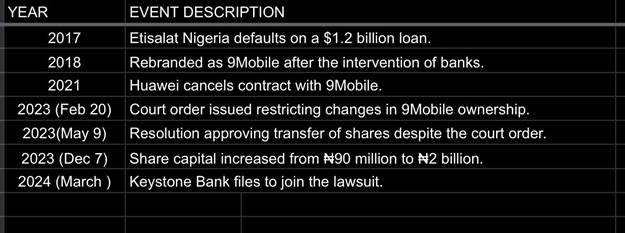

Keystone Bank has filed a motion to be included as a party in the suit, presenting a proposed statement of defense and counter-claim that highlights its interest in the matter. The bank contends that a resolution passed on May 9, 2023, approving the transfer of control of the 5th defendant from the 3rd defendant to the 8th defendant, violated facility agreements and a court order from February 20, 2023, rendering the resolution illegal. Additionally, Keystone challenges a December 7, 2023, resolution that increased the share capital of the 6th defendant from ₦90 million to ₦2 billion, which reduced the 3rd defendant’s shareholding to approximately 4.5%, asserting that this action is null and void.

This development sheds light on the intricate dynamics of corporate power struggles within Nigeria’s telecommunications sector, the influential role of financial institutions in mergers and acquisitions, and the broader implications for regulatory frameworks and investor confidence.

The involvement of Keystone Bank in the 9Mobile ownership dispute is not an isolated event but part of a broader pattern where financial institutions wield significant influence in corporate control, particularly in Nigeria’s telecommunications industry. Banks often serve as key facilitators in telecom mergers and acquisitions, providing financing, restructuring debt, and, in some cases, playing an active role in decision-making when companies face financial distress.

In the case of 9Mobile, the telecom operator has had a turbulent financial history, dating back to when it was Etisalat Nigeria. The company defaulted on a $1.2 billion loan from a consortium of banks, which ultimately led to its rebranding and restructuring. This precedent underscores how banks can transition from being mere lenders to active stakeholders seeking to protect their financial interests. When a telecom firm struggles with loan repayments, banks often step in, influencing ownership structures or facilitating the takeover of assets by new investors.

Keystone Bank’s attempt to join the legal battle suggests that it may hold financial claims or interests tied to 9Mobile’s shareholding, similar to past instances where Nigerian banks have been instrumental in corporate reshuffling. For example, in 2019, Access Bank played a major role in the takeover of Diamond Bank following financial struggles, demonstrating how banks can shape corporate outcomes. Similarly, banks have been known to initiate debt-to-equity conversions, where unpaid loans are exchanged for shares, effectively granting them ownership stakes and decision-making power in distressed companies.

The ongoing ownership disputes and financial challenges surrounding 9mobile, one of Nigeria’s prominent telecommunications companies, have had significant repercussions on its employees and customers. These internal conflicts have raised concerns about the company’s ability to maintain operational stability and deliver quality services.

In recent years, 9mobile has faced a series of internal disputes that have reportedly affected its operations. These conflicts have led to concerns that the company’s focus on resolving operational issues is being undermined by power struggles at the top. As a result, many subscribers believe that the ongoing leadership crisis may prevent 9mobile from overcoming its challenges and delivering the reliable service they expect.

The company’s financial troubles have also led to legal battles with creditors. A Federal High Court in Lagos ordered Teleology Nigeria Limited, the owners of 9mobile, to pay ₦55.7 billion owed to Keystone Bank Limited. However, 9mobile has refuted reports suggesting that a court ordered the company to pay this debt, stating that it was neither a party to any suit nor affected by the order.

These financial and legal challenges have had a direct impact on 9mobile’s workforce. After Huawei canceled its contract with 9mobile in 2021, many engineers who were previously on contract became full-time employees of 9mobile. Over time, however, many of these engineers have been poached by competitors, leading to a talent drain within the company.

For customers, the internal disputes and financial instability have raised concerns about the quality and reliability of services. Subscribers fear that the leadership crisis may hinder 9mobile’s ability to address operational challenges, potentially affecting service delivery and customer satisfaction.

In summary, the ownership disputes and financial challenges facing 9mobile have had tangible effects on both employees and customers. The internal conflicts have led to employee attrition and raised concerns among subscribers about the company’s capacity to provide reliable services.

Beyond 9Mobile, Nigerian banks have historically been deeply involved in the telecom sector, not only through direct lending but also by influencing acquisitions and boardroom decisions. Their vested interests often extend beyond financial recovery; they may also seek to influence management changes or the strategic direction of a telecom firm to ensure profitability and sustainability.

This financial entanglement raises concerns about the broader implications of bank-led corporate restructuring. While banks may act to protect their financial exposure, their involvement can also prolong disputes, delay operational stability, and create an environment where financial institutions, rather than market forces, dictate ownership transitions. The 9Mobile case is a critical example of this phenomenon, illustrating how Nigeria’s banking sector remains a powerful force in shaping corporate control within the telecom industry.

Financial institutions like Keystone Bank play pivotal roles in the telecommunications sector, often extending beyond traditional banking services to become key stakeholders in corporate transactions. Keystone’s involvement in the 9Mobile case highlights how banks can influence mergers, acquisitions, and ownership structures. Such participation is crucial, especially when telecom companies seek financing for expansion or restructuring. However, it also introduces complexities, particularly when financial institutions assert their interests in corporate governance matters.

Prolonged legal battles over ownership can have significant repercussions on regulatory oversight and investor confidence. The Nigerian Communications Commission (NCC) faces challenges in maintaining industry stability amid such disputes. Investors may perceive these conflicts as indicators of an unpredictable business environment, potentially deterring future investments. Ensuring transparent and efficient resolution of such disputes is vital to uphold the sector’s integrity and attractiveness to both local and foreign investors.

The ongoing legal uncertainties surrounding 9Mobile’s ownership could divert attention from strategic initiatives aimed at growth and innovation. Resources that might otherwise be allocated to network improvements, customer service enhancements, or technological advancements could be consumed by legal proceedings. This shift in focus may affect the company’s competitive position in a rapidly evolving market, where agility and innovation are key to retaining and expanding the customer base.

The 9Mobile ownership saga exemplifies how legal strategies and court rulings can shape the trajectory of major corporations in Nigeria. The involvement of entities like Keystone Bank, armed with legal instruments such as counter-claims and motions, illustrates the intricate interplay between law and business. These legal maneuvers can redefine corporate alliances, ownership structures, and even market dynamics, highlighting the critical role of the judiciary in the business ecosystem.

In conclusion, the escalating dispute over 9Mobile’s ownership not only reflects internal corporate challenges but also brings to the forefront the significant roles played by financial institutions, regulatory bodies, and legal frameworks in shaping Nigeria’s telecommunications landscape. The resolution of this case will likely have far-reaching implications, influencing future corporate practices, investor perceptions, and the overall health of the sector.