The recent revelation that President Buhari had presided over a N22 trillion (US $51 billion) borrowings from the Central Bank of Nigeria (CBN) is a classic summary, and encapsulates fiscal policy in the last eight years – buy now, pay later. After the revelation, the rubber stamp Senate approved the President’s controversial ways and means as debt. As expected, the Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC) found the approval disgusting.

The N22 trillion loan from the CBN was extra budgetary spending by the government without approval by the Senate and the House of Assembly, and an unprecedented scale of inflation tax on Nigerians and businesses. Also, the government contravened the CBN Act 2007 that stipulated that “ways and means” should not exceed 5% of the previous year revenue. Worse, Nigerians were lied to and data on budget and deficits were manipulated for eight years. Three months after, there is no indication yet if there will be ever a probe.

The ramifications of the buy now, pay later policy could not have come sooner after President Buhari left office as virtually all the loans raised under his watch are due after he left office. One of such debt is the International Monetary Fund (IMF) US$3.4 billion collected in the thick of the Covid – 19 dynamics of 2020. According to IMF position on Nigeria, the country is expected to repay most of the capital and interest payments on SDR drawings between now and 2025 – SDR 373.81 (US $497.17 million) is due this year, SDR 1,322.01 (US $1.76 billion) is due next year, and SDR 650.58 (US $865.27 million) due in 2025, based on US $1.33 to 1 SDR. Calculated daily, the SDR is determined by summing up the value in US dollars based on market exchange rates of a basket of major currencies – US dollar, Euro, Japanese Yen, UK Sterling, and Chinese Renminbi.

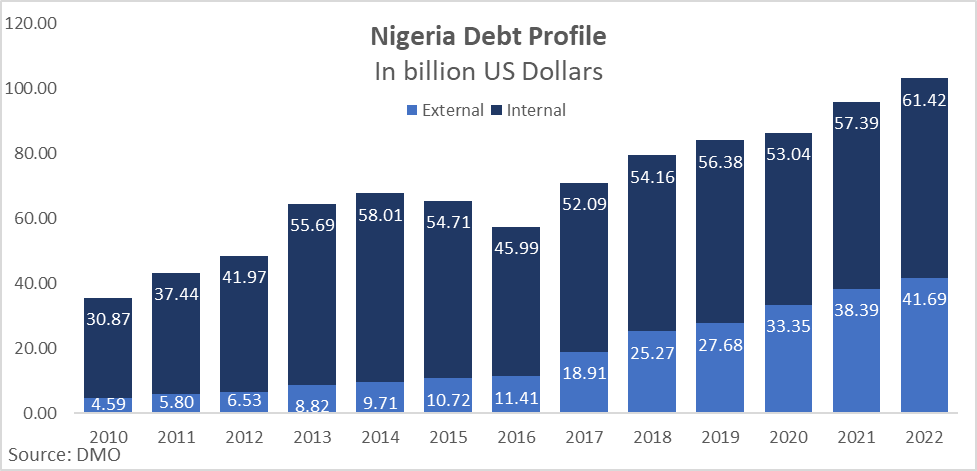

Nigeria’s Debt in US $ in Billions

The graph shows the trajectory of debt in over 20 years, but there is now a sense that this data may not have captured all of Nigeria’s debt in the last eight under President Buhari.By the close of December 2022, the country’s total public debt had surged to N46.25 trillion or $103.11 billion, according to the Debt Management Office (DMO). This figure represents a substantial 14.46 percent increase when contrasted with the N39.56 trillion (USD 95.77 billion) recorded on December 31, 2021. This upward trajectory in public debt is attributed to fresh borrowings undertaken by both the Federal Government of Nigeria (FGN) and sub-national governments. These borrowings have predominantly been employed to bridge budget deficits and fund various developmental projects.

As debt levels rise, concerns about Nigeria’s creditworthiness increases. This could lead to higher borrowing costs for the government in the form of higher interest rates on new debt issuances. It might also make it more difficult for the country to secure favorable terms for international loans. This can increase the risk of sovereign default, which would have severe consequences for the country’s reputation and ability to access international financial markets in the future.

Considering these implications, managing and reducing the public debt burden becomes imperative for Nigeria’s economic stability and sustained growth. Effective debt management strategies, prudent fiscal policies, and measures to enhance revenue generation are crucial to mitigating the potential negative consequences of rising public debt.