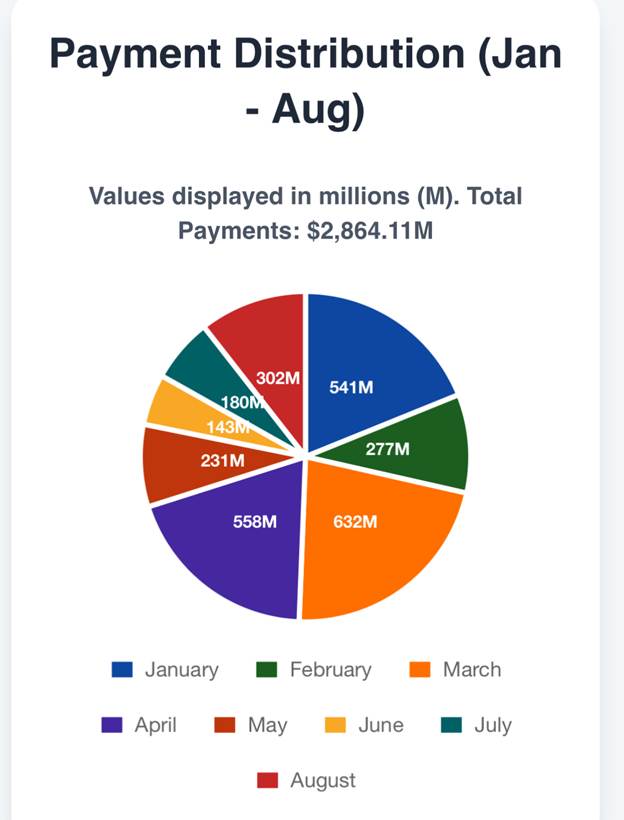

New figures from the Central Bank of Nigeria (CBN) reveal that the country spent $2.86 billion on external debt servicing in the first eight months of 2025. This significant expenditure accounted for 69.1% of Nigeria’s total foreign payments of $4.14 billion during the period, highlighting the dominance of debt obligations in the nation’s external finances.

Essentially, nearly $14 of every $20 that left Nigeria between January and August 2025 went towards servicing debt.

Despite the high proportion of foreign payments allocated to debt, the west African nation did achieve a modest reduction in 2025 compared to the previous year. In the same period of 2024, the country spent $3.06 billion on debt, which represented 70.7% of the total foreign payments of $4.33 billion.

This means Nigeria reduced its absolute debt service bill by approximately $198 million, a 6.49% year-on-year decrease. However, the data underscore a persistent challenge: debt repayments still consume the vast majority of the country’s external obligations.

The monthly data reveal a highly erratic pattern in Nigeria’s debt service obligations for 2025, reflecting the varying structure and due dates of its loans.

Payments fell by nearly 49% from January ($540.67 million) to February ($276.73 million).They then spiked by 129% in March ($632.36 million), which was more than double the payment recorded in March 2024.

Payments remained high in April ($557.79 million) but saw a steep 59% decline in May ($230.92 million), a significant drop from the $854.37 million paid in May 2024.June saw a modest climb ($143.39 million), almost triple the figure from June 2024.

July payments then slipped sharply ($179.95 million), representing a two-thirds decline compared with July 2024.By August, payments recovered to $302.3 million.

According to debt management office report earlier in March, Nigeria owes $45.98 billion to external creditors, which includes multilateral institutions such as: world bank and African development bank; and bilateral creditors with China being a prominent bilateral creditor to fund various infrastructure projects. Futhermore, the external dept are owed to commercial creditors who bought Nigeria bounds in foreign currency.

Despite the pressure from debt payments, a positive development cited in the CBN data is the country’s external reserves. As Nigeria spends less on foreign debt servicing year-on-year, the external reserves have surpassed the $42 billion mark, reaching their highest level in over six years.