A ThinkBusiness Africa poll of economists ahead of the first monetary policy committee meeting of the Central Bank of Nigeria (CBN) since July 2023 sees a major increase in the monetary policy rate (MPR) at the end. They expect the committee to raise the MPR by as much as 300 basis points to reach 21.75%. The CBN’s MPC is set to meet Monday 26 – 27 February 2024.

The meeting has been highly anticipated because it is the first under the leadership of Governor Yemi Cardoso. It is also highly anticipated because there have been significant changes in Nigeria’s macroeconomic environment. For instance, in July 2023, the headline inflation was 24.08%, while inflation is now 30%. The Naira exchanged for about N755 to the US $ while it is about N1500 to the US $ today. Since September, especially in the last two months, the CBN has carried out important and significant measures towards the stabilisation of the Naira, including open market operations, capital control measures, incentives for market players, and the reduction of the net US $ holding by Nigerian banks.

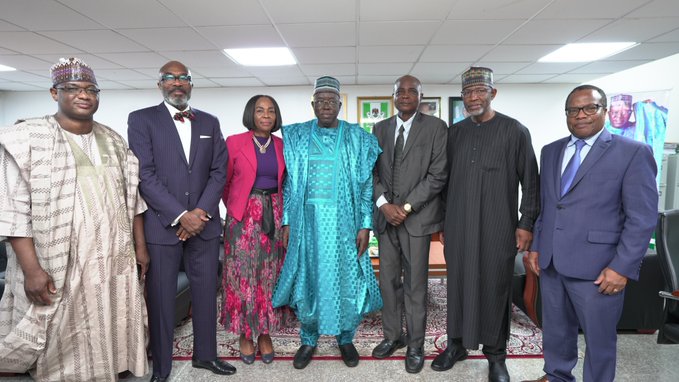

It is also highly anticipated because it is the first MPC meeting for all the current members of the MPC. On Thursday, the Senate confirmed Governor Yemi Cardoso, the four deputy governors, and seven new members to replace the last MPC for which the Governor had described as “ineffective”. The seven new members are Mustapha Akinwunmi, an economist and lecturer at the American University of Nigeria (AUN), Yola; Bamidele A. G. Amoo, also an economist and finance expert; Aku Odinkemelu, a highly experienced banker, with many years’ experience in GTB and Fidelity Bank and also has extensive board experience; Aloysius Uche Ordu, a senior fellow and director of the Africa Growth Initiative at the Brookings Institute; and Murtala Sagagi, currently a director in the CBN and was previously of the Dangote Business School, Bayero University in Kano. The other two members are Lamido Yaguda, the current Director General of the Securities and Exchange Commission, and Jafiya Lydia Shehu, the current permanent secretary of the Federal Ministry of Finance.

As in the past, the new MPC members are a combination of deep economic knowledge and experience. This time, in addition to economics knowledge and expertise, the Bank have appointed those with a deep knowledge of how the Bank works. Amoo, Sagagi, and Yaguda all have CBN experience, while Odinmekelu have been in the corridors of GTB and Fidelity.

Ahead of the meeting, it is very clear that the MPC has the most difficult job to see how it can complement recent monetary policy measures. As Ayo Teriba, one of Nigeria’s renowned economists said on “The Economists conference” by Proshare on Friday, “the actions (by the MPC) will be affected by the extent of volatility during the meetings on Monday and Tuesday”.

Recall that the last MPC of the CBN was the 292nd and was held in July 2023. The decisions reached included raising the Monetary Policy Rate (MPR) to 18.75%. The asymmetric corridor was adjusted to +100 / – 300 basis points around the MPR while CRR and Liquidity Ratio were retained at 32.5% and 30%, respectively. On 21st September, the CBN announced the postponement of the planned 293rd meeting till further notice, given that an entire new Board of Governors have just been appointed. According to the existing timetable at the time, the next MPC was expected to hold 20 – 21 November 2023, but that was not held as well.