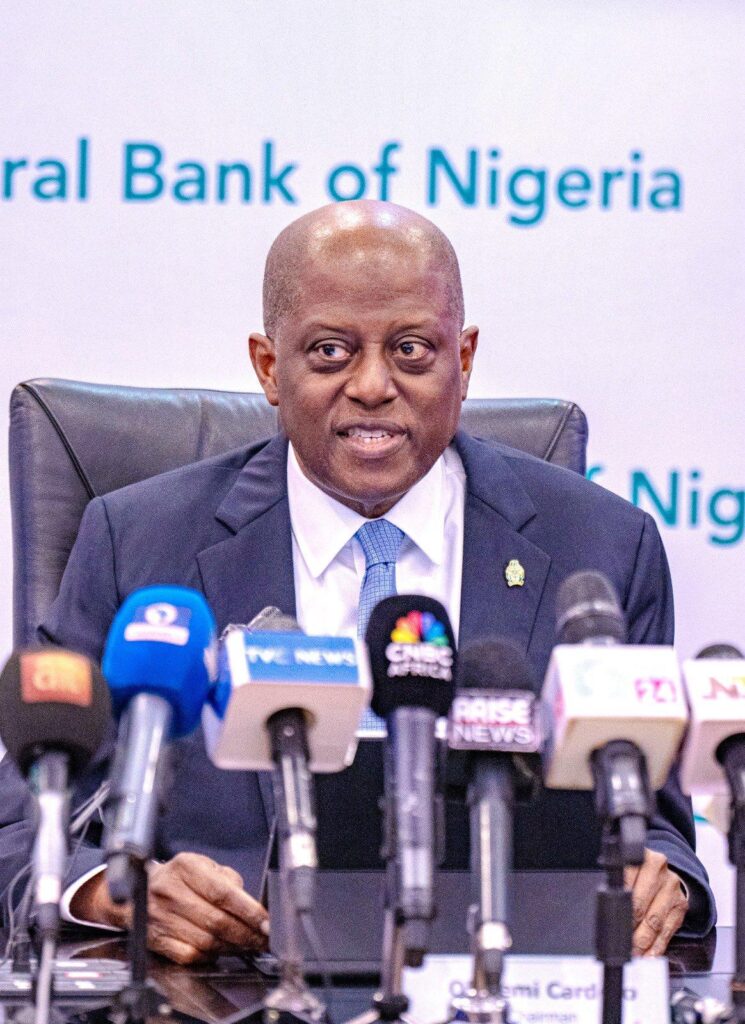

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has announced a slight shift in its monetary policy, cutting the Monetary Policy Rate (MPR) by 50 basis points from 27.5% to 27%. CBN said in a statement on Tuesday.

However, this marks the first reduction in the key interest rate in five years, signaling a potential new direction in the western Africa country’s economic strategy. The decision, made at the 302nd MPC meeting on Tuesday. reflects the committee’s assessment of current economic conditions and its outlook on inflation and growth.

In addition to the MPR cut, the MPC also made adjustments to other key policy parameters. The Cash Reserve Ratio (CRR) for commercial banks has been reduced to 45% from 50%; while the CRR for merchant banks was maintained at 16%.

The Liquidity Ratio (LR) remains unchanged at 30%. The Asymmetric Corridor around the MPR was maintained at +250 and -250 basis points, continuing to guide lending and deposit rates for banks.

The primary beneficiaries of this rate cut are expected to be businesses, particularly small and medium-sized enterprises (SMEs) that rely on bank loans to finance their operations and expansion.

With the MPR as a benchmark, the cost of borrowing for commercial banks is now lower, which should translate to reduced lending rates for businesses.

This cheaper access to credit could encourage new investments, facilitate business expansion, and ultimately lead to job creation. The reduction in the Cash Reserve Ratio (CRR) for commercial banks to 45% further supports this, as it frees up more capital for lending.

Before the Central Bank of Nigeria’s (CBN) recent rate cut, the country’s monetary policy had been on an aggressive tightening path for several years. The primary objective was to combat a stubborn and escalating inflation rate, which had reached a 28-year high (34%) in 2024 and is now cooling off (20%) in August 2025.

Inflationary pressures were fueled by several factors, including the removal of fuel subsidies, the unification of foreign exchange windows leading to a significant depreciation of the Naira, and global supply chain disruptions.

The CBN, under the new leadership, had prioritized price stability as its main goal, raising the Monetary Policy Rate (MPR) from a low of 11.5% in 2022 to 27.5% by early 2025. This series of sharp rate hikes, while aimed at taming inflation and attracting foreign portfolio investments, also came with a trade-off: a slowdown in economic growth as the cost of borrowing for businesses and consumers became prohibitive.

This move by the CBN is expected to inject more liquidity into the financial system, potentially stimulating credit growth and economic activity. Analysts and investors will be closely watching the impact of these changes on the market and the broader economy in the coming weeks and months.