By: Chidozie Nwali

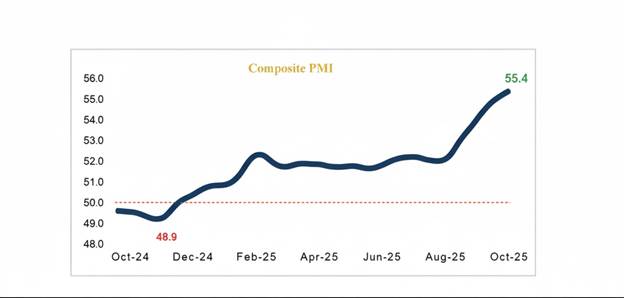

Nigeria’s private sector activities accelerated sharply in October, with the Composite Purchasing Managers’ Index (PMI) climbing to 55.4 index points, signaling a stronger and broader expansion across the economy. This marked the eleventh consecutive month of business expansion, December 2024 till October this year, PMI index has remained above 50 points.

This, according to the latest Central Bank of Nigeria (CBN), October PMI report.

“Composite PMI for October 2025 stood at 55.4 points, signaling expansion in aggregate economic activity for the eleventh consecutive month. Out of the 36 subsectors covered in the survey, 25 experienced expansion in economic activity.” The report noted.

(A reading above 50 points signifies expansion, while a reading below 50 indicates contraction.)

The report showed a notable increase from the 54.0 points recorded in September 2025, indicating that business conditions are improving as Africa’s leading economy enters the final quarter of the year.

The strong PMI data aligns with recent macroeconomic stabilization efforts made by Nigerian monetary authorities.

In September 2025, the CBN’s Monetary Policy Committee (MPC) reduced the Monetary Policy Rate (MPR) by 50 basis points to 27.00 per cent, citing sustained disinflation and the need to support recovery.

This rate was effective throughout October, demonstrating a cautious pivot towards growth support. The CBN’s efforts have seen the naira stabilize and foreign reserves cross $43 billion (as of early November).

Last month Nigeria was removed from the Financial Action Task Force (FATF) grey list, which has boosted investor confidence and reduced the cost of international financial transactions.

Output components leads, businesses scale up According to the report, overall positive performance was largely driven by robust increases in market demand and production. The strongest components of the Composite PMI were:

- Output (57.2 points) recorded the highest expansion, reflecting businesses successfully scaling up production and service delivery.

- New Orders (56.0 points): Strong growth in new business orders indicates rising customer confidence and market vitality.

- Employment Level reached 53.8 points as Businesses continued to hire staff for the fifth consecutive month, suggesting increasing commitment to capacity building.

This modest job growth contrasts with Nigeria’s official unemployment rate, which was last reported around 4.3 per cent (June 2024), but the PMI suggests consistent movement toward greater employment stability.

Agriculture and services lead sectoral growth

All three primary economic sectors—Agriculture, Services, and Industry—maintained expansionary paths, with the non-industrial sectors exhibiting the strongest performance:

- The Agriculture Sector climbed 55.7 points in October recording the longest sustained growth streak, marking its fifteenth consecutive month of expansion. All five subsectors surveyed in agriculture reported growth, driven primarily by strong increases in general farming activities.

- The Services Sector recorded 55.6 points indicating its ninth consecutive month of sustained expansion. Eleven out of the fourteen subsectors in the services group recorded growth, with the Educational Services subsector posting the strongest expansion across the entire survey.

- The industrial sector’s PMI strengthened significantly from 51.4 in September to 54.2 points in October, reflecting increased industrial activity. Nine of the 17 subsectors saw expansion, led by Printing & Related Support Activities.

However, the Petroleum & Coal Products subsector reported the most severe contraction, highlighting continued volatility in the extractive sector. The report dismissed the contraction as “insignificant.”

“The overall impact was insignificant to offset the broad-based expansion observed across the other subsectors.” The report noted.

High inflation remains a headwind

Despite the widespread expansion, the report signaled sustained high-cost pressures, particularly within the food production value chain. The Agriculture Sector recorded the widest gap between input and output prices at 8.4 index points.

This wide margin suggests that while agricultural activity is increasing, producers are facing sharply rising costs for crucial inputs (such as fertilizers and logistics), which they are either unable or unwilling to fully pass on to consumers. This dynamic points to either significant margin compression for farmers or sustained inflationary risk in food prices, which remains a key concern for the overall economy.

In the Industry Sector (54.2 points), challenges persist, dampening its contribution. Despite the expansionary PMI, the sector’s real GDP growth remains subdued (1.60% YoY in Q2 2025 according to Nigerian Bureau of Statistics NBS).

The fact that 8 out of 17 subsectors contracted—with Petroleum & Coal Products showing the most decline—highlights severe structural impediments.

Manufacturers are currently grappling with significant port bottlenecks, which stall the clearance of imported raw materials. This, combined with unreliable power supply, high energy/logistics costs, and a widening N14.3 trillion trade deficit in the first half of 2025, continues to deter foreign investment and limit the sector’s long-term competitive potential.