By: ThinkBusiness Africa

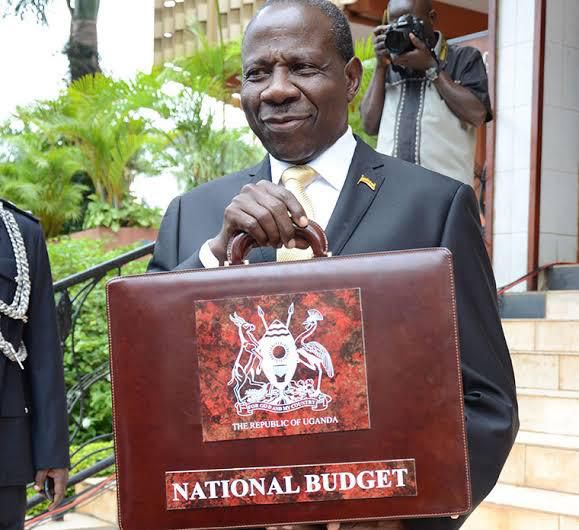

Uganda’s economic momentum accelerated in November 2025, marked by a dramatic improvement in the national trade balance and a surge in export earnings. Uganda finance ministry’s report showed on Wednesday.

According to the latest Performance of the Economy report, the country’s merchandise trade deficit narrowed by an impressive 70.4%, falling to $74.46 million in October 2025, compared to $251.56 million during the same period last year.

This shift was driven by a near-doubling of merchandise exports. Earnings skyrocketed by 94.4%, reaching $1.496 billion in October 2025. This growth the finance ministry said was robust enough to overshadow a significant $549.74 million increase in imports.

Key contributors to this export boom included: Strong performances from coffee, cocoa beans, and flowers.

The East African country also saw Increased gold exports driving its of foreign exchange (FX) reserves.

In the 12 months leading up to June 2025, Uganda’s gold earnings reached an all-time high of $4.21 billion, a significant increase from $2.98 billion recorded in the prior period; accounting for nearly 40% of Uganda’s total export revenue.

Uganda FX reserves gross $5.4 billion in November, up from $3.2 billion recorded in the previous year, providing 4 months of import cover.

High-frequency indicators suggest that the broader economy is in a healthy expansion phase. The Purchasing Manager’s Index (PMI) climbed to 53.8 in November, up from 53.4 in October. Any reading above 50.0 indicates an improvement in business conditions, and firms are currently reporting a steady rise in new orders and output.

Similarly, the Business Tendency Index (BTI)—which measures the perceptions of senior executives—stood at 57.20. While this represents a slight dip from previous months, it remains well above the 50-mark threshold. Optimism is particularly concentrated in the manufacturing, wholesale trade, and services sectors.

Ugandans saw further relief in the market as annual headline inflation declined to 3.1% in November, down from 3.4% in October. This disinflationary trend was largely driven by a sharp drop in food crop inflation, which fell from 6.1% to 4.0% due to an improved domestic food supply.

The government attributes this resilient performance to private sector dynamism and favorable agricultural yields. With the Composite Index of Economic Activity (CIEA) rising to 183.50, the trajectory for the final quarter of 2025 remains positive.