The International Monetary Fund (IMF) has projected that Zambia’s public debt-to-GDP ratio will fall to approximately 91.1% by December 2025, marking the first time in over seven years that this critical indicator will dip below the 100% threshold.

According to the IMF’s Country Report No. 25/225, released on August 5, 2025, this milestone is a testament to Zambia’s ongoing economic reform efforts and successful debt restructuring under the Extended Credit Facility (ECF) programme.

The report further forecasts a continued decline, with the ratio expected to reach 69.4% by 2027, signaling a robust trajectory toward fiscal sustainability.

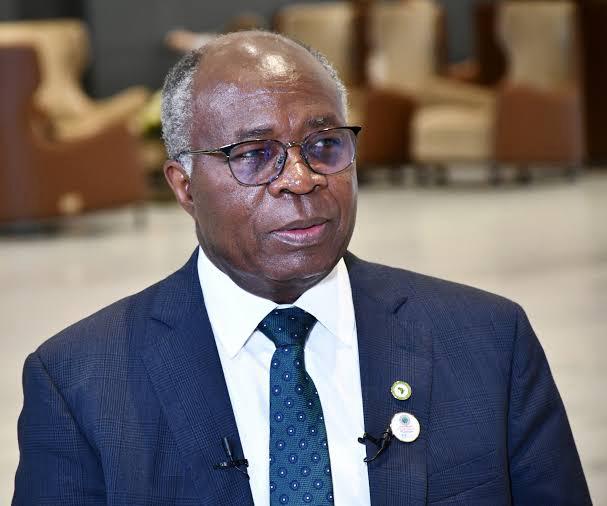

The announcement has been met with optimism by Zambia’s Minister of Finance and National Planning, Dr. Situmbeko Musokotwane, MP, who hailed the development as evidence of the government’s prudent economic management.

“Numbers don’t lie. Our prudent economic management and debt restructuring efforts are beginning to bear fruits. The difference is evident,” Dr. Musokotwane stated in a press briefing.

He emphasized that a declining debt-to-GDP ratio is a key indicator of macroeconomic stability, reflecting an economy growing faster than its debt obligations.

“The lower the public debt-to-GDP ratio, the greater the investor confidence in our market and in our economy, and the result of this is more jobs, more development, and more wealth for the nation,” the Minister added.

This reduction in the debt-to-GDP ratio is expected to enhance Zambia’s creditworthiness, lower borrowing costs, and strengthen its standing with international financial institutions, development partners, and global investors.

Despite facing significant challenges, including a severe drought in 2024 that impacted agriculture and electricity generation, the Southern Africa economy has shown remarkable resilience.

The IMF estimates real GDP growth at 4% in 2024, driven by strong performances in the mining and services sectors, with electricity access prioritized for productive sectors. The report projects growth to accelerate to 5.8% in 2025, supported by a rebound in agricultural production, increased copper output, and continued strength in mining and service

The IMF’s Country Report No. 25/225 attributes Zambia’s improved debt outlook to a combination of effective fiscal consolidation, successful external debt restructuring, and a strengthened macroeconomic framework under the 38-month ECF programme, which was approved in August 2022 with an initial allocation of US$1.3 billion, later augmented to US$1.7 billion in June 2024.

The ECF has facilitated significant fiscal and structural reforms, including the restructuring of Zambia’s external debt under the G20 Common Framework. A key milestone was the agreement with Eurobond holders in March 2024, finalized in June 2024, which provided substantial debt service relief.

Inflation, which peaked at 16.8% in February 2025 due to higher food prices and kwacha depreciation, is expected to decline gradually to 11% by the end of 2025, reflecting the Bank of Zambia’s tight monetary policy stance and easing food and fuel prices.

Gross international reserves have also increased, reaching US$4.7 billion by mid-May 2025, equivalent to 4.1 months of import cover, bolstering Zambia’s external resilience.