Markets

| % Change | YTD (%) | ||

| NGX ASI | 64,603.69 | 2.48% | 26.05% |

| Brent Crude Oil | 78.24 | -0.29% | -8.93% |

| Natural Gas | 2.65 | 2.59% | -35.37% |

| I&E FX Window | 744.07 | 4.23% | -66.27% |

| Parallel Market | 782.00 | 1.94% | -5.68% |

| Nigerian Treasury Bill (Average Yield %) | 6.12% | 0.00% | -0.82% |

| FGN Bonds (Average Yield %) | 13.26 | 0.02% | 12.18% |

| Gold | 1,922.93 | -0.07% | 5.99% |

| Cocoa | 3,309.00 | 0.58% | 26.99% |

- The equities market sustained the upward movement on Monday as NGX ASI rose by 2.48% as Dangote Cement Plc announces the commencement of the Tranche I share buyback program. The benchmark NGX All-Share Index (ASI) soared 1,563.28 points to close at 64,603.69, representing a week gain of 4.28%, a 4-week gain of 15.31%, and an overall year-to-date gain of 26.05%. Dangote Cement led the gainers with 10% share price appreciation closing at NGN 330.10 per share, followed by MRS Oil Nigeria (+10%), Neimeth International Pharma (+10%) and Jaiz Bank (+10%).

- Oil prices slipped on Monday, retreating from Friday’s ten-week high amid continued concerns about the world’s two biggest economies – U.S. and China. WTI Crude traded at US $73.15, down by 0.96% on the day. The international benchmark, Brent Crude, was down by 0.29% at US $78.24.

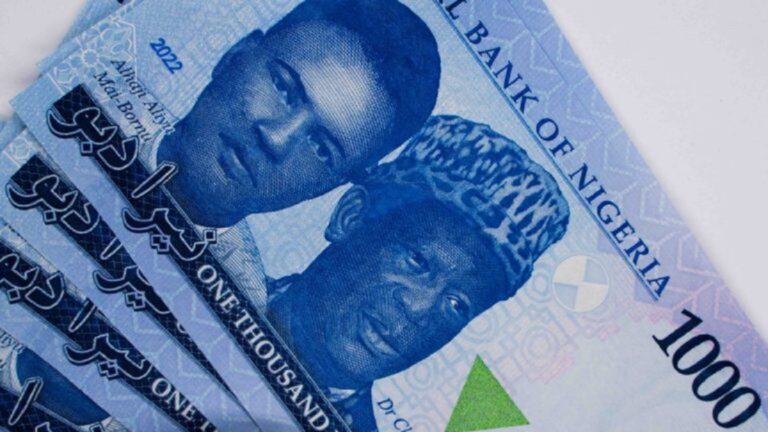

- Both the I & E and street markets saw Naira up – by 4,23% to close N744.07 at the I &E, and by 1.94%, closing at N782.50 on the streets.

- U.S. natural gas futures climbed about 3% to US$2.65, a one-week high on Monday on forecasts for hotter weather that should boost cooling demand more than previously expected through late July, especially in Texas.