The US is seeking to extend the Africa Growth and Opportunities Act (AGOA) for another 20 years from 2025. US Senator John Kennedy introduced the AGOA extension bill S.2952 early this month, was read on the floor twice and referred to the Senate’s Finance Committee. The process is expected to be completed by year end. But in about 25 years, AGOA has not delivered as much as it should have for African economies.

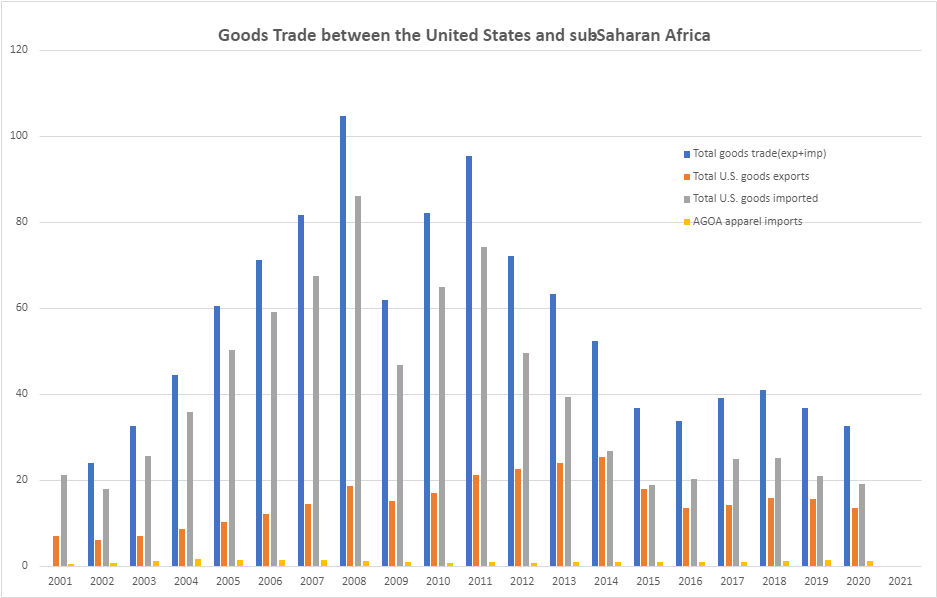

As largely expected by promoters of the historical trade deal, AGOA was touted a necessary tool and instrument for changing the pattern of Sub Saharan African (SSA) trade from primary to largely manufacturing and processed products with increasing value additions. In addition, the access to the US $25 trillion economy was supposed to lead to remarkable growth in SSA’s non-oil exports to the US. However, the latest data available show little progress on these fronts. For instance, for the combined 36 eligible countries, figure shows that exports into the US under AGOA is a miniscule US $4.8 billion for non-oil exports for 2021.

Indeed, in the last report prepared in 2022, the US government emphasised non-oil exports as critical to AGOA ideals. The report says, “a positive sign of the reemergence of strong trade and investment ties between the United States and SSA is that in 2021, non-oil imports under AGOA (a major source of AGOA’s job creation value) were approximately US $4.8 billion. This represented a sizeable increase from US $3.4 billion and US $3.8 billion in 2020 and 2019, respectively, and was the largest annual figure since 2013.”

The year after AGOA was signed, combined exports by SSA economies was US $21 billion and by 2021, it was US $28.2 billion. The history of AGOA shows that the export under the initiative is masked by oil exports. The trajectory of oil exports and that of apparel under the same AGOA is a clear demonstration that Africa’s trade pattern with the largest economy in the world has not changed. In over 20 years of AGOA, the highest value of exports of apparel was US $1.6 billion in 2004, and the figure was US $1.4 billion in 2021. In over 20 years, SSA economies have not been able to break into the US and global chain of apparel exports despite AGOA.

Ahead of the extension, the US sees the continuation of the trade scheme as necessary contribution to Africa’s growth, development, democracy, and reduction in poverty through trade and to counter the increasing influence of China on the continent. AGOA was first introduced in 2000 during the presidency of the 42nd President Bill Clinton and extended for another 10 years in 2015. The current top good exporters trading with the US under AGOA are South Africa (US $15.7 billion), Nigeria (US $3.7 billion), Ghana (US $1.7 billion), Cote d’Ivoire (US $1.2 billion) and Angola (US $1.1 billion). Besides South Africa, virtually all other exporters were largely primary product exporters. Meanwhile, AGOA allows over 1800 products into the US free of duty. This is in addition to the more than 5,100 products that are eligible under the Generalised System of Preferences (GSP) programme.

However, there have been significant shifts on the continent since 2000. China’s development initiatives on the continent, especially through the Belt and Road initiative has been remarkable. Africa has also established the Africa Continental Free Trade Area (AfCFTA). These two considerations are fundamental to the shifts that both the US and SSA countries will see in the next wave of trade under AGOA, especially in relation to building capacity for trade in SSA economies.

For instance, despite extensive trade capacity building by the US and an investment of US $8.5 billion over a 20-year period, trade capacity remains a challenge in SSA economies. The 2022 report shows that for many of the eligible countries, national AGOA strategies were completed in the last five years. Botswana (2021), Kenya (2018), Lesotho (2018) and Zambia are the countries that have updated versions. Meanwhile, Nigeria is one of very few countries without a national strategy for AGOA.