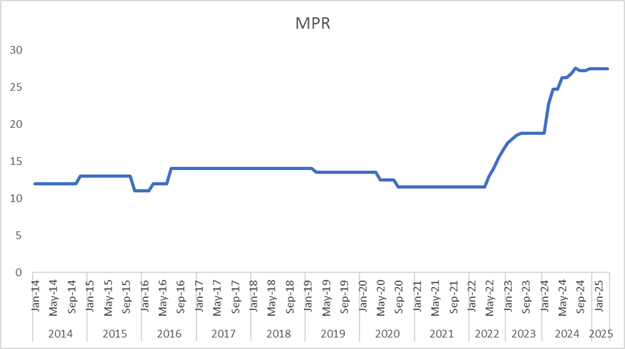

After the first monetary policy committee meeting of the year, which leaves the monetary policy rate unchanged at 27.5 percent, it appears Nigeria is set for a stable monetary policy this year. The decision to leave rates unchanged was the first time under the leadership of Yemi Cardoso. The governor had led a regime of consistently raising interest rates since February 2024, from 18.75 percent to reach 27.5 percent in November 2024. The committee also left the Cash Reserve Ratio (CRR) at 50 percent for commercial banks and 16 percent for Merchant Banks, liquidity ratio at 30 percent, and the asymmetric corridor and +500 and -100 basis points. Essentially, while the CBN has not responded to calls to lower interest rates, it has paused its recent raises to curtail inflation.

Fig. 1 The Central Bank of Nigeria Monetary Policy Rates January 2014 to February 2025

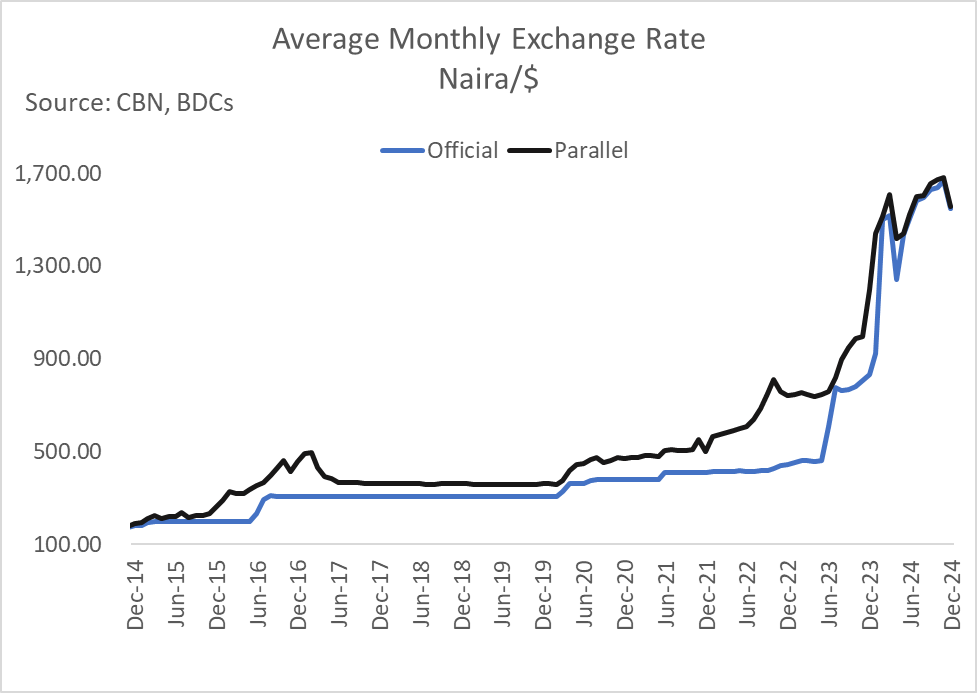

The MPC decision came amidst recent announcement by the National Bureau of Statistics (NBS) that it has rebased the Nigerian economy, updating the base year for both Gross Domestic Product (GDP) and inflation to 2024, from the initial 2010. The recent rebasing is already one rebasing short of the requirement that economies should rebase every five years according to the United Nations Statistical Commission (UNStat). The decision to leave the rates unchanged also come after the Naira has remained largely stable for over six months now, from June 2024.

Following the rebasing and the announcement that inflation in January 2025 was 24 percent, it means that the MPR is above the inflation rate for the first time since …… , allowing the realistic possibility that the MPC will reduce its MPR when it meets in April. The rebasing has also allowed the CBN to maintain its stance that it is committed to curtailing inflation through the limited monetary policy tools available to it. By also supporting the recent strengthening of the Naira against the USD and other internationally traded currencies, the CBN is coordinating its policy and actions towards reduction in the rate of inflation and interest rates.

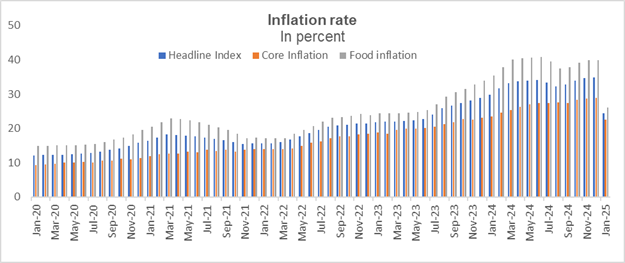

Fig. 2 Nigeria’s Inflation Rate

However, the CBN recognises that the greatest constraint is the stability of the exchange rates. The reserves, though grown from US $33.5 billion in February 2024 to over US $40 billion at the end of 2024, has now declined to US $38.5 billion, which covers about a year level of current imports, higher than the three months “rule of thumb.” Over time, ThinkBusiness Africa analysis have argued that Nigeria reserves should be a target of US $100 billion, not because it is what covers three months of imports, but because it represents a significant level of reserves as “insurance” for macroeconomic stability.

Fig. 3 Naira’s exchange rate with the US $

Unlike this time last year, there are developments that now supports the concrete possibility of a stable monetary policy outlook for the rest of the year. The most important is that virtually all petroleum motor spirit (PMS) is now produced in the country. Following the commencement of the production of petroleum products at the Dangote refinery, the use of an estimated 20 – 25 percent of Nigeria’s foreign exchange earnings on the importation of petroleum products has largely ceased. Indeed, OPEC in its February 2025 report said, “the Dangote Refinery reaching full production capacity should help stabilise the petroleum product supply and possibly lower petrol prices.” And just few days ago, Dangote refinery announced new lower prices for its petroleum products, as predicted by OPEC.

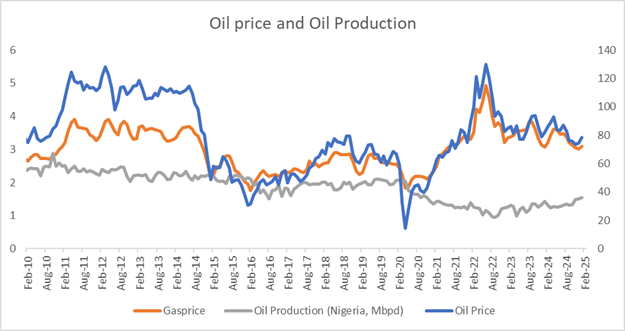

Also, this time last year, Nigeria’s foreign reserves was at US $33.5 billion, compared to US $38.5 billion in February 2025, lower than a high of US $40 billion in December 2024. In addition, crude oil production was at about 1.3 million barrels per day but now it is now above the 1.5 million barrels per day OPEC quota for the country.

Fig.4. Crude Oil Production and Price 2010 – 2025.

Though risks remain, especially the possibility of lower crude oil prices in response to increases in crude oil supply by the US, following the commitment of the new US President Donald Trump to increase production, the outlook for a stable monetary policy outlook is at its best since Yemi Cardoso became Governor of the Apex Bank in September 2023.

Indeed, at the annual banker evening in Lagos late last year, the governor had argued that the effects of CBN policy measures in 2024 will become more evident by the first quarter of 2025. As he predicted, though relying on rebasing, inflation has started to decline. Furthermore, the CBN forecasts a Gross Domestic Product (GDP) growth of 4.17% for 2025, driven by ongoing reforms and an expected increase in oil production. Foreign exchange reserves are also projected to rise, bolstered by higher oil output, which is expected to reach 2.3 million barrels per day by mid-year.

The CBN’s persistent monetary tightening reflects its dedication to curbing inflation and stabilizing the Nigerian economy. While the nation continues to face significant inflationary challenges, particularly in food and energy sectors, the central bank’s proactive measures aim to restore price stability and foster economic growth in the coming year.