By: ThinkBusiness Africa

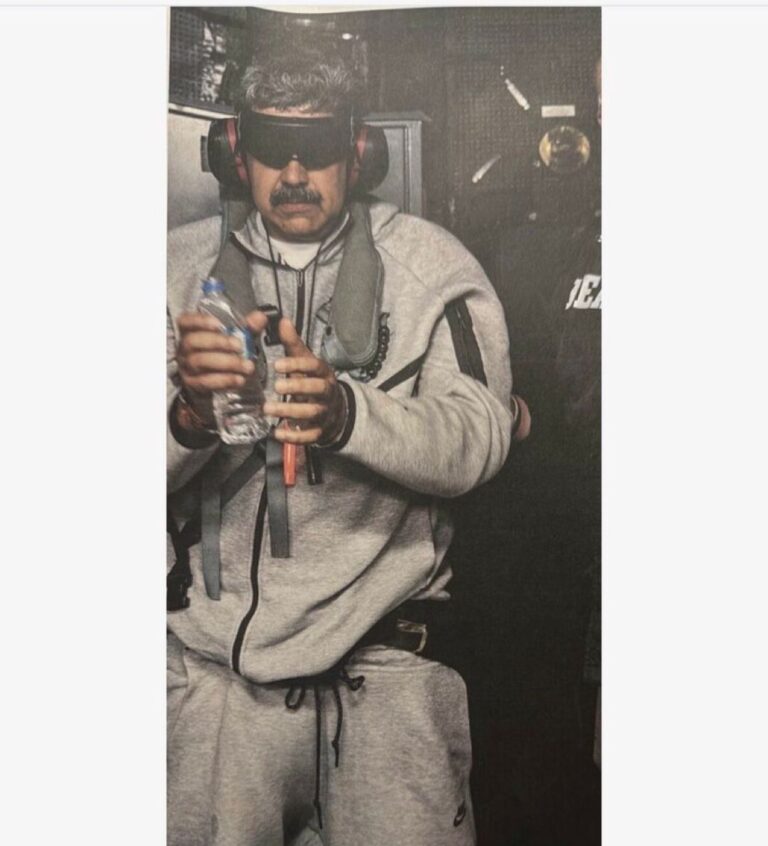

The Dangote Group president and founder Aliko Dangote, has announced a landmark plan to list a 10% equity stake in its multi-billion dollar refinery and petrochemicals complex on the Nigerian Exchange (NGX), tentatively scheduled for 2026, and comes with an unprecedented payment of dividends in US Dollars. Dangote said on Thursday.

While speaking at the unveiling of Dangote Group long-term vision 2030, the group president noted that stocks will be traded in Nigeria’s local currency Naira but dividends will be paid in US dollars.

“You buy in naira, but you get dividends in dollars,” Dangote stated, outlining a strategy explicitly designed to offer Nigerian investors a crucial hedge against the persistent volatility and depreciation of the local currency, the Naira.

This structure is a major deviation from the standard practice for companies listed solely on the NGX. The company expects the dollar payouts to be fully funded by its substantial foreign currency earnings.

Dangote stated that the export-oriented nature of the refinery’s operations, particularly the fertilizer and petrochemical businesses, is projected to generate over $6.4 billion in annual revenue inflows for the country, assuring investors that the funds for the dollar dividends will not rely on the Central Bank of Nigeria (CBN).

The initial public offering (IPO) is planned for 2026, following the model of successful previous listings of other Dangote subsidiaries, such as Dangote Cement and Dangote Sugar.

Dangote Group is currently working closely with both the Nigerian Exchange (NGX) and the Securities and Exchange Commission (SEC) to establish the necessary regulatory framework for the dollar-denominated dividend payment.

The refinery listing is a pivotal component of the Dangote Group’s ambitious “Vision 2030,” which aims to transform the conglomerate into a $100 billion revenue enterprise with a market capitalization exceeding $200 billion.

The refinery itself, which is the world’s largest single-train facility with a production capacity of 650,000 barrels per day (bpd) and plans to expand to 1.4 million bpd, is considered key to achieving Nigeria’s energy self-sufficiency and becoming a net exporter of refined petroleum products.

In November, the refinery announced that it’s going to meet all Nigeria’s domestic premium motor spirit (PMS) demands in December, by supplying 1.5 billion liters monthly into the Nigerian petroleum market.

This figure, which is equivalent to approximately 50 million litres per day, is widely considered sufficient to meet the nation’s entire daily consumption requirement, which typically hovers between 50 and 60 million litres.

Financial analysts and capital market observers anticipate that the refinery listing will be transformative for the Nigerian capital market

The listing of such a large and valuable entity (the refinery is valued at over $20 billion) will significantly deepen the market, providing a massive boost to the NGX’s overall market capitalization and liquidity.

Should the plan receive full regulatory approval, it could set a new standard for Nigerian companies, particularly those with significant foreign currency earnings, encouraging similar dividend structures to enhance investor appeal.

The Nigerian capital market now awaits the final regulatory approvals from the NGX and SEC to see how this groundbreaking financial model will be implemented, a move that could redefine the landscape of domestic equity investment.