Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN) has reiterated the Bank’s commitment to containing inflation in the country. The governor said that the Bank, under his leadership will continue the orthodox approach to rein in inflation.

Though inflation was 33.88 percent on October, from 32.7 percent in September, and food inflation at 39.16 percent, exceeding the 21 percent target set by the Bank, Cardoso argued that what we are seeing is a time lag between the policies of the CBN and the impact on prices. According to him, this lag can be between six and nine months. Accordingly, he says the Bank expects there will be reduction in current inflation trajectory from Q1 2025.

On the structural dimensions of inflation in the country, the governor says that the Bank is cooperating and working closely with all relevant government departments to deal with them. According to him, the Bank will continue to provide advisory role. In addition, the Bank is doing all it can on foreign exchange markets to minimize distortions to achieve the true value of the naira.

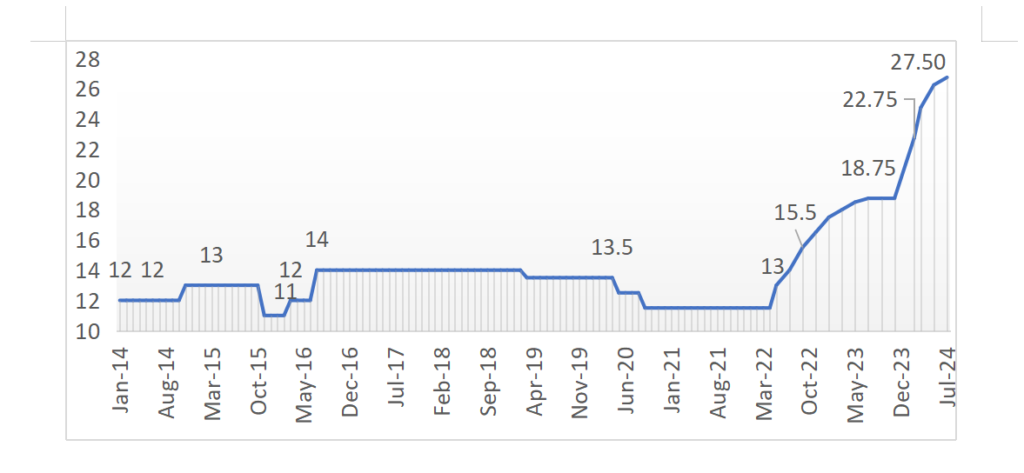

The governor made the comments when answering questions during the press briefing that followed the 298th meeting of the Bank’s monetary policy committee (MPC), where the committee increased the Bank’s monetary policy rate (MPR) to 27.50 percent, retains the CRR (Cash Reserve Ratio) of Deposit Money Banks (DMBs) at 50 percent, retains CRR of Merchant Banks at 16 percent, and Liquidity Ratio at 30 percent. This is the sixth time in a row that the Bank is raising its MPR, seeking to contain rising inflation in the country.

Fig. 1 Changes in CBN’s Monetary Policy Rates.

The governor also alluded to global challenges around inflation. He said he expects the declining inflation in key economies towards the target of 2 percent to happen sometime next year, albeit gradually. Also, the progress that has been made in economies that are seen inflation reductions is on the back of the same approach they have taken in relation to Nigeria’s inflation. “The road of travel is similar, and we expect to reap the benefits. We are not alone in the challenges on inflation and exchange rate and we are on the right path,” he argued.

The governor also expressed his delight on the growth of diaspora remittances, rising from previously US $250 million to US $600 million per month. He said this has been on the back on the Bank’s deliberate policies to address bottlenecks. It followed meetings with the International Money Transfer Operators (IMTOs) earlier this year. They have restructured and made it easier for the setting up accounts, following collaborations with the banks and the Nigeria Inter Bank Settlement System (NIBSS). This progress will culminate in banks being able to offer nonresident account programmes starting next month. In line with the progress made on money laundering measures, the governor says the Bank expects Nigeria to exit the grey list of the Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog.

According to him, after meeting lower level of reserves and huge backlog, “the process of getting here has been a long and arduous one, but the policies have started to bear fruit.” Addressing the matter of growing reserves and weakling naira, the governor argued that the reserves are there to defend the country’s economy following any unexpected shocks. More so, the naira has been stable since June 2024. “The CBN will do all it can to ensure stability”, he argued.