By: ThinkBusiness Africa

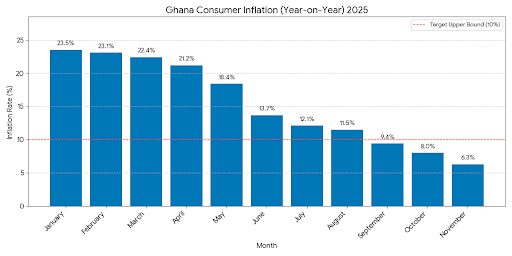

The West African nation’s inflation slowed to 6.3% year-on-year in November, down sharply from the 8.0% recorded in October. This remarkable drop marks the eleventh consecutive month of disinflation, positioning Ghana firmly within its central bank’s medium-term stability band. Ghana Statistical Service (GSS) said on Wednesday.

The November figure, which is the lowest since June 2021, is seen as a significant victory for the government and the Bank of Ghana (BoG)’s rigorous macroeconomic stabilization program, which is supported by the International Monetary Fund (IMF).

Ghana’s inflation peak was 23.5% in January, the highest in 2025, and had since been on a downward trajectory.

Source: BoG

Headline inflation print of 6.3% not only beat market expectations but also fell comfortably within Ghana’s central bank target range of 6%-10%. A dramatic reversal from over 54% peaked in late 2022.

In November, BoG monetary committee members slashed its benchmark Monetary Policy Rate (MPR) by an aggressive 350 basis points (bps) to 18.0%. After delivering over 3 rate cuts earlier this year.

Since July 2025, the committee members have reduced the MPR by a cumulative 1,000 basis points, a decision they said was primarily driven by the sustained and sharp decline in consumer inflation; unwinding a period of historically high rates used to combat the surging inflation of previous years.

The Ghana Cedi has shown significant resilience appreciating over 20% against the US Dollar throughout this year, largely due to strong performance in key export sectors like gold and cocoa, coupled with restored international confidence. stronger cedi has lowered the cost of imported goods, easing imported inflation pressure.