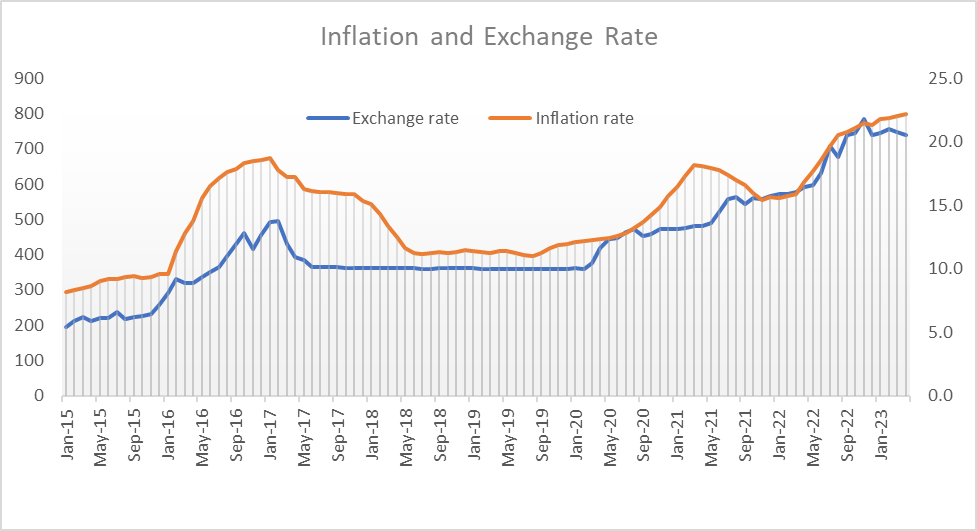

April inflation numbers, the last before President Buhari left office, rose to 22.2%, from 22.04% in March, fourth consecutive monthly increase and the highest inflation rate since September 2005. Though the rate of increase has slowed, inflation has not peaked yet.The graph below shows the dynamics of inflation and the Naira’s exchange rate to the US $ under the President.

Nigeria’s Inflation Rate and Exchange Rate with the US $ under President Buhari

The graph above shows the movement between the country’s rise in the costs of goods and services and the exchange rate to the US $. It clearly shows the results of the three macroeconomic shocks under President Buhari – the one he inherited in 20215, Covid – 19 global economic shock, and the Russian /Ukraine war that would have been net positive or at best neutral if domestic economic conditions and management were right. While the shocks were the source of the macroeconomic imbalances, President Buhari’s catastrophic economic policies made it worse through his Idi Amin’s style monetary policy accommodation, as now evidenced by the N22 trillion “buy now, pay later” inflation tax.

Between 2014 and 2016, the Central Bank of Nigeria (CBN) devalued the Naira 8times from N161in September to N305 in Sept 2016, while gaps and arbitrage opportunities started to emerge, as the parallel market rate increased from N175 in Nov 2014 to N431 in Sept 2016. The same patterns emerged after the Covid – 19 and the Russian / Ukraine war shocks.

At the May 22 – 23 monetary policy committee (MPC) of the CBN, the monetary policy rate (MPR) was raised from 18% to 18.5%. It had signaled in the last meeting that it will continue to tighten on the expectations that the government will remove fuel subsidy. That is not going to happen anymore. It said at after the meeting, and it has shown again, that the rate of increase has slowed, but inflation is still very sticky.

As in other macroeconomic imbalances, the expectation is that the new administration will provide concrete measures to provide confidence that it can stabilise the economy in the medium term. Three of such measures will include a credible economic team, a weak appetite for deficits, and closing the distortionary gap between the I & E window and parallel rates of Naira’s exchange rate to the US $.