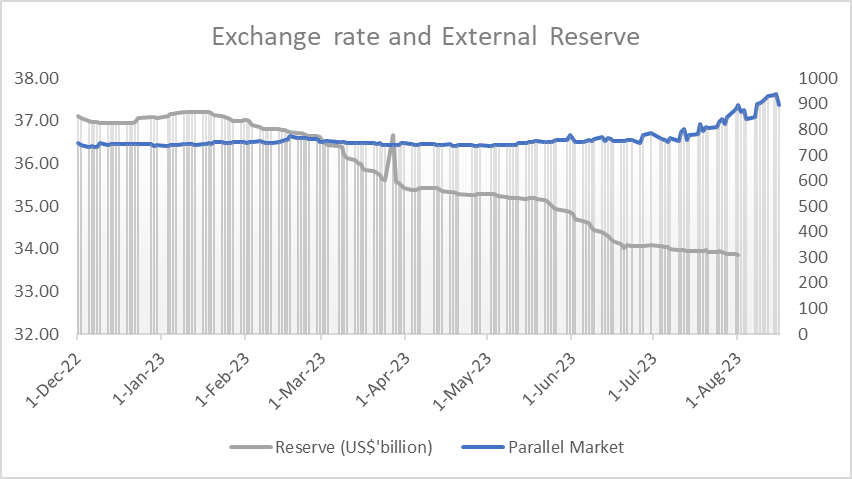

The Nigerian National Petroleum Company Limited recently announced it has secured a US $3 billion emergency loan from Afreximbank. The loan will be used in supporting the ongoing fiscal and monetary policy reforms of the President. The Naira has been on free fall since the aggregation of all the Central Bank of Nigeria’s exchange rate windows into the I&E window, depreciating about 27%, after an earlier about 40% devaluation two weeks after President Bola Tinubu assumed power. The Naira currently trades to the US $ at N922 on the streets. This unsettling trend was accompanied by a steady reduction in the country’s external reserves, further contributing to the currency’s weakened state.

The aggregation of all exchange rate windows into the I&E window and the removal of the restrictions on the exchange rate has led to a depreciation of about 27% in two months. Before June 13, 2023, the I&E window had witnessed an average exchange rate of N465/$ in May 2023. Following the lifting of the restrictions, we now have fluctuations in the range of N740-795/$ at the I&E window. Worse, the arbitrage that was eliminated has reappeared, with theNaira exchange rate to the US dollarnow N930-950/$ on the streets. In the same period, the external reserve declined to US$33.86 billion as of August 14, 2023, 9% or US $3.22 billion since the start of the year.

The driving forces behind the depreciation of the Naira and the resultant widening of the exchange rate premium are multifaceted. The key point though is that both demand and supply are not responding to price changes in the short term. The source of supply that is largely within the control of the government – crude oil supply – is in grave danger, with July production barely above 1 million barrels a day. Meanwhile, capital importation has exhibited a prolonged decline, with data from the National Bureau of Statistics (NBS) showing a 45% reduction, from US$2.19 billion in Q4 2021 to US$1.32 billion in Q1 2023.