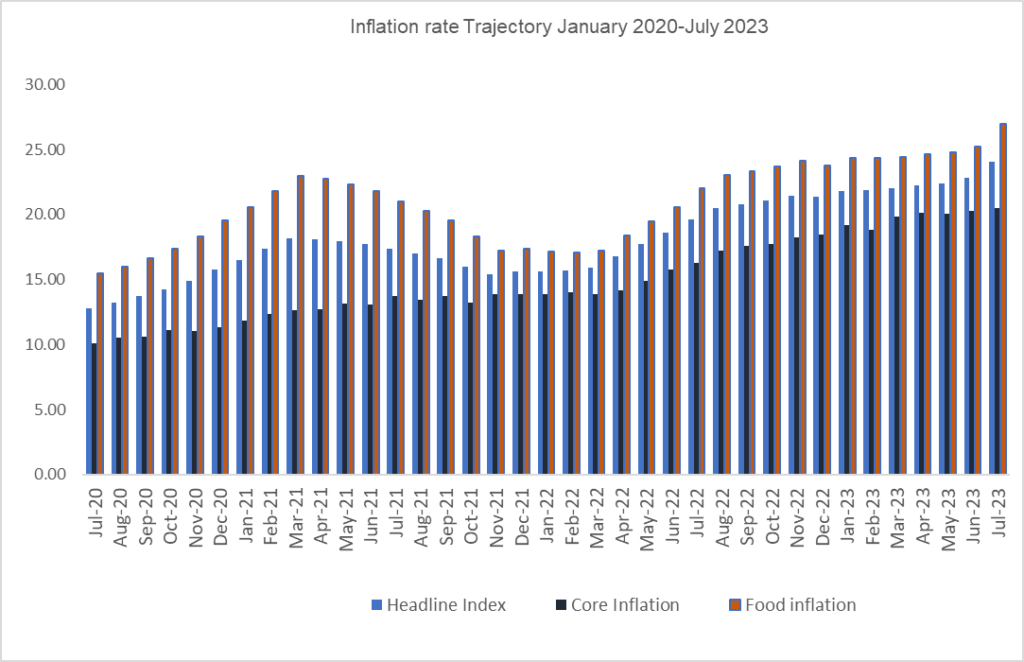

The National Bureau of Statistics (NBS) unveiled the inflation data for the month of July, shedding light on the evolving economic landscape. Headline inflation rate for July 2023 surged to 24.08%, marking a substantial increase from the June 2023 rate of 22.79%. This translates to an uptick of 1.29% points in the span of just one month, `underscoring the rapid pace of inflationary pressures following the removal of fuel subsidies.On a year-on-year basis, the headline inflation rate exhibited an even more pronounced ascent, standing at significant 4.44% points higher than the corresponding period last year, which recorded a rate of 19.64%.

Factors driving up prices are amplified energy prices, depreciation of the Naira, and the surge in money supply. These factors have collectively contributed to the overarching inflationary pressures that we see. The July inflation figures also provides a comprehensive snapshot of the impact of the removal of the exchange rate cap, directly impacting core inflation, which soared to a rate of 20.47%.The persistent rise in food inflation further exacerbates the overall inflationary landscape. In July 2023, food inflation registered at a substantial 26.98%, compared to previous month’s rate of 25.25%, following increases in transportation costs, agricultural planting season, and the prevailing security challenges that have impacted supply chains.

The outlook is further rise in inflation. The ongoing reforms are anticipated to exert substantial upward pressure on consumer prices throughout the latter half of 2023. As a result, inflation is projected to average over 25% for the entirety of 2023, marking the most substantial annual rate since the 1990s.

The rising cost and volatility of the exchange rate is the greatest driver of Nigeria’s inflation. Acknowledging this, the acting governor of the Central Bank of Nigeria (CBN), after meeting with the President says they will embark on measures to stabilise the Naira. He warned speculators that the Bank will take measures over the next few days which he did not spell out that he expects will improve the position of the Naira on the streets. As of the following Monday, the rate at the I&E window stood at N744.41/$ and the street market rate stood at N935/$, this shows a gap of 25.6% or N190.59.

Fuel imports is another, but also dependent on the Naira’s exchange rate to the US dollar. Fuel imports into Nigeria fell to 106,000 barrels per day (bpd) in July 2023, from the 205,200 barrels per day recorded in May 2023, a near 50% decline in fuel imports. It follows the removal of fuel subsidy by the government on May 29th. Since then, transports costs have increased by as much as 100% in some instances and raised food prices. The data is provided by S&P global commodity insights. It is consistent with the data from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) that fuel consumption in Nigeria dropped to 46.38 million litres per day following the removal of the subsidy. Meanwhile, fuel prices are expected to rise further following volatility and the weakening of the Naira. The expectation is that fuel price will reach N700 per litre in the coming weeks based on a Naira to US $ of N900. The government has now directed that fuel prices should not rise beyond N600 per litre.

As expected, the National Bureau of Statistics ((NBS) has shown that the average fare paid by commuters for bus, motorcycle, air, and water journeys went up, increasing by as much as 97.88% for inner city and 42% for intercity bus journeys in June, compared to May 2023. It reflects the observation that, after the near 200% increase in fuel prices on May 29th – shorter trips doubled in prices while longer trips did not increase as much.To control inflation, the CBN had recently strengthened its orthodoxy approach by raising rates to 18.5% in its last meeting.