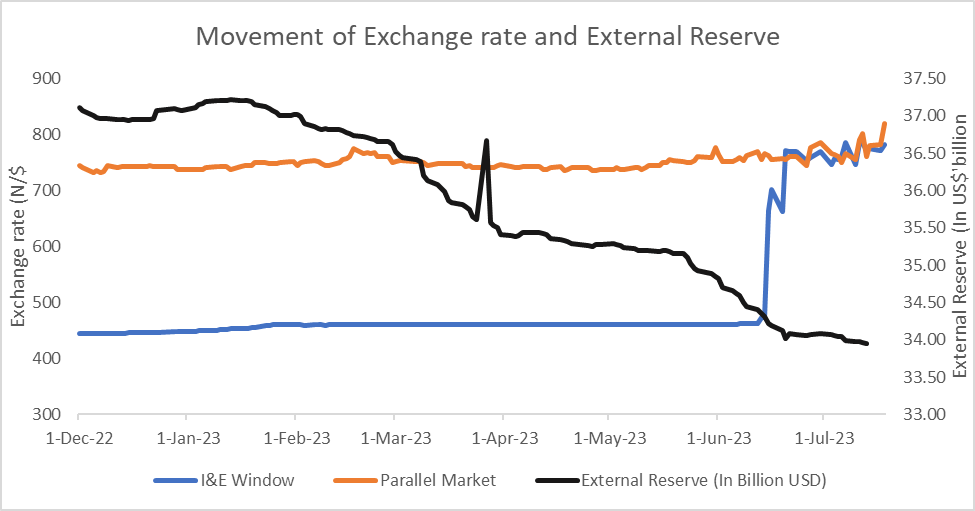

According to data from the Central Bank, Nigeria’s external reserves have seen a decline from US $37 billion to US $33.9 billion as of July 2023, a decline of US $3.1 billion, following significant and rising macroeconomic risks – crude oil theft, weak foreign direct investment (FDI), and rising uncertainty. Meanwhile, demand and supply have remained inelastic, even after exchange rate adjustments while there are debt repayments, capital flights and continuous inflationary pressures.

In the last two months, since the inception of the Tinubu administration on May 29th, 2023, external reserves have dropped by almost US $billion dollars. This decrease occurred despite efforts to unify the Naira’s exchange rates and implement a managed exchange rate float. The external reserve typically relies on funding from crude oil proceeds, external debts, and foreign investor inflows.

This is the largest half-year decline since 2015 when the external reserves fell from US $34.4 billion at the year’s end of 2014 to $28.1 billion by the end of the first six months of June 2015, following dramatic declines in oil prices. Nigeria’s central bank attributes current decline in reserves to a lack of external debt financing. The country is unlikely to tap into the foreign debt market this year due to higher global interest rates, particularly affecting emerging market Eurobonds, though this has started to fall.