Travelers from Lagos and Abuja international airports in the last three months have been confronted with about 300% – 400% difference in prices compared to those that fly from Cotonou airport in Republic of Benin and Kotoka airports in Accra, Ghana. It became common for Nigerians to pay an average of about US $2000 – US $3000 for return trips to Europe in the busy months of August and early September.

It follows the lingering airlines trapped funds, now estimated at close to a US $1 billion. Speaking to an attendant in one of the airlines offices in Lagos, he said the airlines, not sure of when they will recover their trapped funds, are not only charging more in case they are not able to recover the trapped funds, but also that passengers are paying in US dollars. The new aviation minister recently said he will work on the matter in relation to Emirates.

However, it is not only airlines that have their trapped funds in the country. Fast Moving Consumer Goods (FMCG) companies and portfolio investors are also caught up in Nigeria’s severe macroeconomic challenges and resultant capital flow restrictions. Indeed, they were perhaps the most delighted after the Central Bank aggregated all foreign exchange windows into the importers and exporters (I&E) window. They had expected that the policy will make it easier for their estimated US $10 billion to recovered. For portfolio investors that exited the capital market or sold some of their shares, their trapped funds accrued on the back of their inability to exit Nigeria. For the FMCGs, they borrowed foreign currencies from parent companies for their inputs and raw materials.

Even before June 40% devaluation of the Naira, it was difficult to estimate how much was trapped in the country, as some may have been converted it into other uses until there is an opportunity for them to exit. That brings us to what is likely to happen to the data below. Foreign airlines were the most agitated. Following the trapped cash, they provided windows for Nigerians to buy tickets using their US dollar or Sterling Cards, raising the costs of international tickets as explained above.

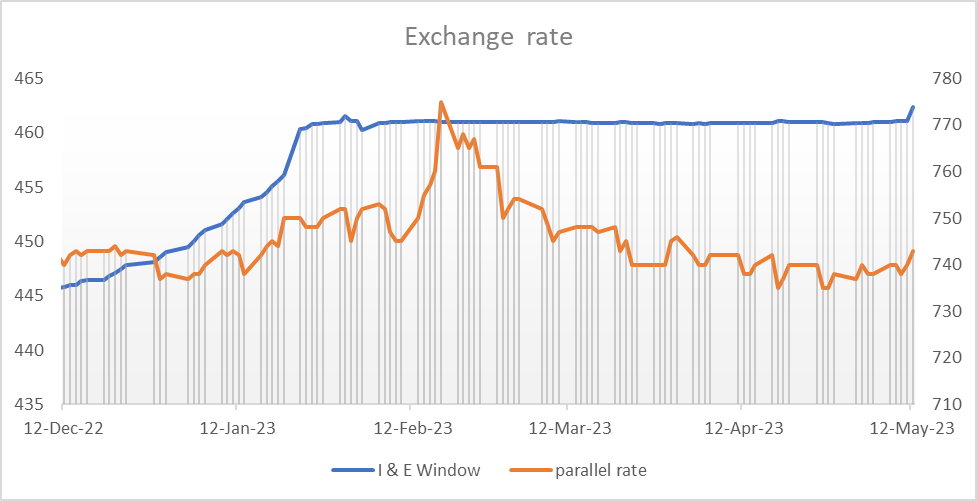

Naira Exchange Rates with the US $ at the I & E and the Parallel Market

To reflect changing economic conditions and mitigating exchange rate risks, they raised exchange rates applied to flight tickets multiple times. For instance, in May, they raised Rate of Exchange, (RoE) from N610 per dollar to N634 per dollar. It was as a continuous fall out of about US $800 million trapped funds in the country. From March 2023 – N460 / $, to N551 / $, to N610 / $, and in May to N634 /$. Foreign airlines trapped funds increased from $744million in March to $802 million in April despite several means deployed to avoid collection of their funds in Naira, to reduce the amount of money trapped in Nigeria.

The stampede that followed the aggregation of all exchange rate windows and devaluation reflects downside risks to international investments in Nigeria, including the concession of some major airports in the country. Second, E-commerce that relies on aviation for speedy delivery were impacted by the trapped funds in Nigeria. Also, and it is already the case, Nigerians are paying far more for equivalent international travel tickets, and worse since June.

In matters of economic decisions, especially relating to investments, the greatest costs are usually the opportunity costs. Nigeria is increasingly losing its hard-earned credibility won in the 2000s and early 2010s for relatively macroeconomic stability, the minimization in investment distortions, and general sound macroeconomic management. The new government have started all over again and grind to regain any sort of credibility before the investments will start to come in again.

Why? There are many reasons, but the bottom line is the increasingly weakening and worsening macroeconomic environment that means, currently in Nigeria, investment flows are largely one-way traffic out of the country, including by domestic residents.