Nigeria’s NLC and TUC is encouraged to obey court order

Following the planned industrial action by two of Nigeria’s largest trade unions, the Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC), the attorney general of the federation (AGF) and Minister of Justice Lateef Fagbemi, has urged the bodies to respect and obey court order. The country’s industrial court had ruled in June prohibiting any form of industrial action in relation to the removal of fuel subsidy. The AGF said that if the October 3rd strike goes ahead, it will be against a subsisting order of the court. Rather the trade union bodies should continue negotiations with federal government of Nigeria. However, most Nigerians can relate to this – court orders are rarely respected, including by the government.

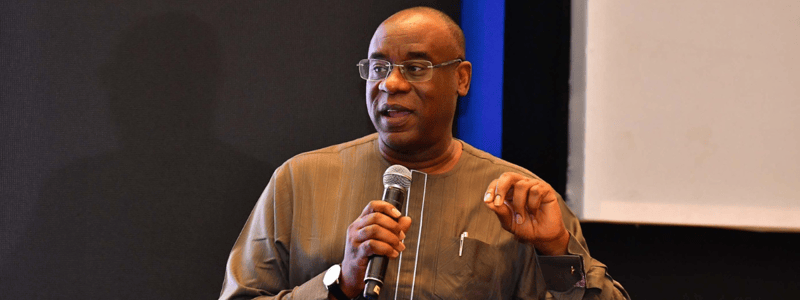

IMF’s fiscal policy recommendations for developing economies

The International Monetary Fund (IMF) has urged developing economies, largely Sub-Saharan economies to improve on the capacity to collect taxes to improve government’s fiscal position. It urged these economies to concentrate on eliminating tax exemptions and reducing fiscal deficits. The IMF recommends improvement in tax collection in preference to reducing critical expenditure that would invariably lead to long term reduction in growth. In Nigeria, for instance, tax exemptions and waivers is estimated to cost the federal government in excess of N6 trillion. Meanwhile, Taiwo Oyedele, the chairman of Nigeria’s President Bola Ahmed Tinubu committee on fiscal policy and taxation has said they will improve on the measures to increase the taxes the rich pays for them to reach the 18% target of tax to GDP ratio set for 2026. The current ratio is 6%.

Market Roundup 29th September 2023

Oil futures slid about 2% on Thursday, as traders took profits after prices earlier soared to 10-month highs and some worried that high interest rates may weigh on western economies and oil demand. On its second to last day as the front-month, Brent futures for November delivery fell US $1.65, or 1.7%, to US $94.90 a barrel by 1:51 p.m. EDT (1751 GMT).

Market Roundup 28th September 2023

Oil prices surged 3% on Wednesday to the highest settlement in 2023, after a steep drop in U.S. crude stocks compounded worries of tight global supplies. Brent crude futures closed up US $2.69, or 2.86%, at US $96.65.

Market Roundup 26th September 2023

Oil prices nearly flat in Monday trade as Russia relaxed its fuel ban, after earlier gains on a tighter supply outlook, while investors eyed elevated interest rates that could curb demand. Brent crude futures flat at US $93.37 a barrel while the U.S. West Texas Intermediate crude was down 25 cents at US $89.78.

Market Roundup 25th September 2023

Oil prices held steady on Friday but closed the week lower as markets weighed supply concerns stemming from Russia’s fuel export ban against demand woes from future rate hikes. Brent futures settled 3 cents lower at US $93.27 a barrel.

21st August 2023 Africa Market Roundup

On Friday, the benchmark NGX All-Share Index (ASI) climbed 295.00 (0.46%) points to close at 64,743.96, concluding a week loss of 0.89%, a 4-week loss of 0.4%, but an overall year-to-date gain of 26.33%. John Holt share price led the gainers, followed by Consolidated Hallmark Insurance (+8.24%), University Press (+6.67%) and Computer Warehouse Group (+5.56%).

20th August 2023 Africa Market Roundup

Markets % Change YTD (%) NGX ASI 64,448.96 -0.27% 25.75% Brent Crude Oil 84.19 0.89% -2.01% Natural Gas 2.63 2.50% -35.85% I&E FX Window 740.67 0.14% -65.31% Parallel Market 890.00 4.30% -20.27% Nigerian Treasury Bill (Average Yield %) 6.94% 0.00% 13.21% FGN Bonds (Average Yield %) 13.84% 0.07% 17.07% Gold 1,886.71 -0.27% 4.00% Cocoa 3,418.00 1.36% 31.17%

17th August Africa Markets Roundup

Markets % Change YTD (%) NGX ASI 64,625.28 -0.47% 26.1% Brent Crude Oil 83.46 -1.68% -2.85% Natural Gas 2.59 -2.44% -36.83% I&E FX Window 759.86 1.59% -69.56% Parallel Market 935.00 0.64% -26.35% Nigerian Treasury Bill (Average Yield %) 6.94% 0.00% 14.68% FGN Bonds (Average Yield %) 13.84% 0.07% 17.09% Gold 1,893.04 -0.19% 4.35% Cocoa 3,372.00 1.17% 29.40%

15th August Africa Market Roundup

Markets % Change YTD (%) NGX ASI 65,210.49 -0.18% 27.24% Brent Crude Oil 86.46 -0.40% 0.58% Natural Gas 2.79 0.72% -31.95% I&E FX Window 744.41 -0.61% -66.14% Parallel Market 935.00 0.53% -26.35% Nigerian Treasury Bill (Average Yield %) 7.03% 0.00% 14.68% FGN Bonds (Average Yield %) 13.66% 0.00% 15.57% Gold 1,909.95 -0.19% 5.28% Cocoa 3,304.00 0.3% 26.79%