By: ThinkBusiness Africa

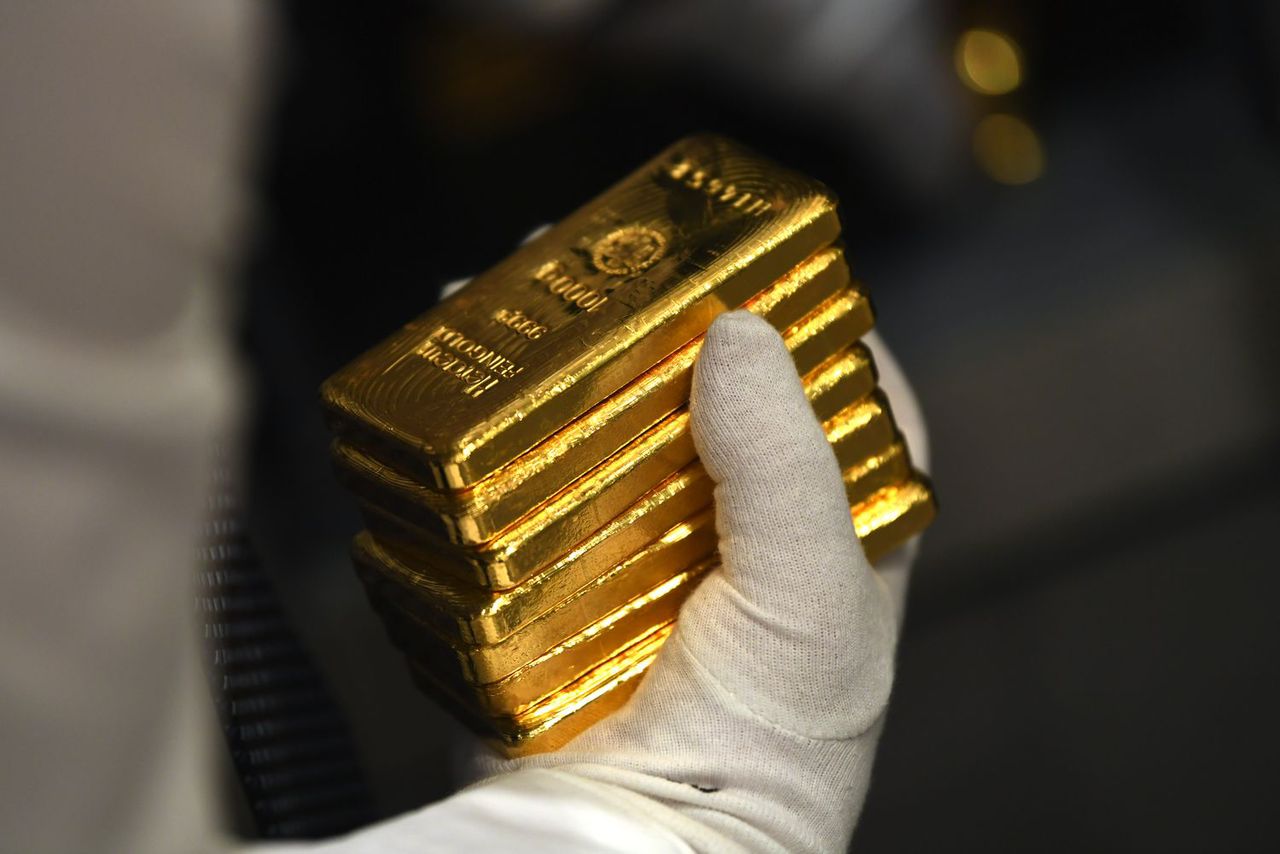

Gold prices rose past the historic $5,000 per ounce threshold early Monday, as a relentless wave of safe-haven buying swept global markets. Data from tradingview shows the precious metals reached an all-time high of $5,081.18, driven by a volatile wave of aggressive U.S. tariff threats and escalating military tensions in the Middle East.

The primary catalyst for Monday’s surge remains the deepening rift between the United States and its European allies over Greenland. Following President Trump’s recent moves to press for the acquisition of the autonomous territory, the administration has threatened a “sliding scale” of tariffs—starting at 10% and potentially reaching 25% by June—on eight NATO and EU nations, including Denmark, France, and Germany.

In a dramatic escalation over the weekend, the White House further expanded its trade offensive, threatening a 100% tariff on Canadian goods and 200% on French wines.

Middle East Tensions and the “Board of Peace”, created at the World Economic Forum (WEF), last week are adding fuel to the rally, and intensifying threats from Iran. Following reports of a significant U.S. naval mobilization in the region, Tehran warned it is “ready for war” and may target U.S. bases if military pressure continues.

Market anxiety is also high regarding the proposed “Board of Peace,” a U.S.-led initiative intended to bypass traditional United Nations channels for conflict resolution. Critics argue the move undermines international law, while markets view the resulting diplomatic uncertainty as a clear signal to move into non-sovereign assets.

The rally isn’t limited to gold. Silver shattered its own psychological ceiling on Friday, crossing $100 per ounce for the first time in history.

As the U.S Federal Reserve prepares for its January 27–28 meeting, many institutions are already revising their targets. While gold has already gained 17% in the first three weeks of 2026, some technical analysts suggest that if the Greenland dispute remains unresolved, the metal could test $6,000 per ounce by early April.

With central banks—led by China—continuing a 14-month buying spree and retail investors piling into Exchange-traded funds , the yellow metal has reclaimed its throne as the world’s ultimate arbiter of fear.