The Nigerian Extractives Industry Transparency Initiative (NEITI) stated that Nigeria made only US $1.4 billion from solid minerals in 13 years, a miserable average of about US $100 million per year. This was said at the launch of the initiative’s 2022–2026 Strategic Plan in Abuja recently. It follows an earlier report by the World Bank report – Africa’s Resource Future Report that Nigeria and other metals and minerals resource rich countries in Sub Saharan Africa (SSA) can double revenues from natural resources such as minerals, oil, and gas.

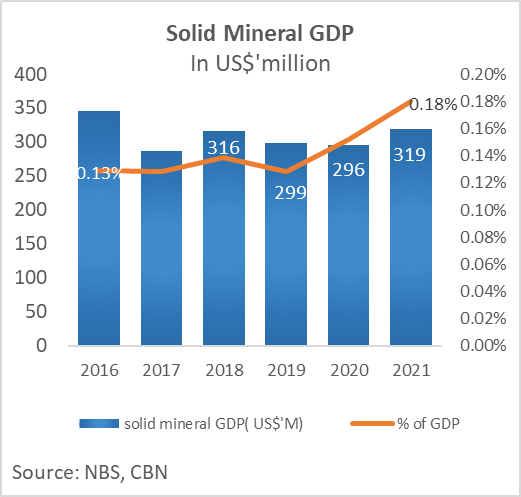

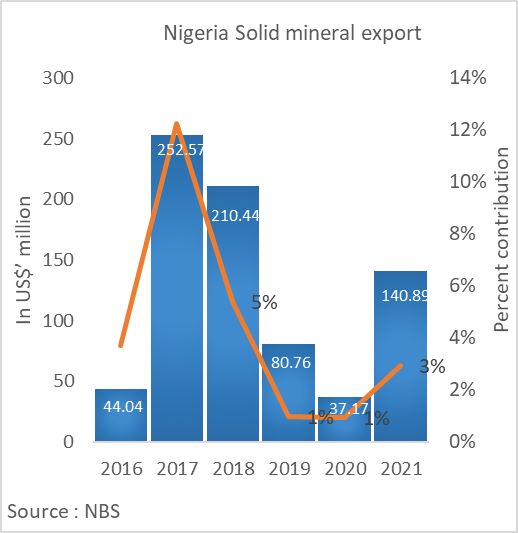

According to the report, African countries can scale, and considerably, revenues from Solid minerals by better set of policies, implementing reforms, investing in better fiscal administration, and promoting good governance. Nigeria is blessed with more than 44 solid minerals including gold, tantalite, barite, limestone, bitumen, kaolin, and topaz, spread across more than 500 locations in the country. According to National Bureau of Statistics (NBS) data, solid minerals contribution to GDP is 0.15% between 2016 and 2021, with about 2% growth rate. In 2021, the size of the solid minerals sector was US$319million, contributing 0.18% to the GDP, while export was US$141 million.

Solid minerals production in constant US $ Millions

The solid minerals sector has been battling many problematic issues. First is the lack of satisfactory geo science data that captures location and scale of the solid minerals in the country. This is the most important investment required before the sector can attract major players. There is also significant illegal mining and fragmentation of mining firms. The latest data revealed that the Mining Cadastre Office (MCO) have issued 1,296 mineral licenses, and 702 firms paid royalties to the government, with just 74 enterprises paying $3 million or more.

Because of the fragmentation and size of mining companies, 80% to 85% of current mining activities in Nigeria is via artisanal and small-scale mining and the mining sales channel is largely unofficial, embedded with smuggling and distribution, with estimated loss to the country of US $9 billion, according to NEITI. Then, lack of infrastructure. Lack of infrastructure has cost miners. Mining relies significantly on infrastructure such as transportation, power, and rail, all of which are in poor conditions in Nigeria.

Experts believe Nigeria can unlock its natural resources through the following ways. First, investment in geo-science data gathering. Although the government achieved 100% aerial geo-physical survey of the country, with data existing at the ministry of mines and steel development for would be miners. Second, Nigeria can strengthen the mineral buying centers. Nigeria have more than 93 certified Private mineral buying centers and more than 10 prototype Minerals Buying Centers created by the federal government across the country, but these has been largely ineffective and underutilized. This has enabled the flourishing of illegal sale cartels out of the country, with resultant loss of solid minerals revenue from taxes and royalties.

Third, encourage and implement the one local government one mineral policy. In cooperation with state and local government and involvement of the private sector will help to bring out in a sustainable manner the solid minerals in each local government. In form of compensation, a 5%-7% derivative will be remitted back to the state and local government.