Reports from word bank noted Nigeria’s macroeconomic situation is significantly improving as a direct result of sustained economic reforms; however inflation rate will maintain its double digits while it’s expected to fall to an annual average of 22% in 2025.

This was disclosed in world bank’s latest edition of Nigeria development update (NDU) titled “building momentum for inclusive growth”

The recent NDU shows that economic growth in the last quarter of 2024 increased to 4.6% year-onyear (yoy), pushing growth for the full year 2024 to 3.4%, the highest since 2015 (excluding the 2021-2022 COVID-19 rebound) the growth was driven by service and modest oil production recovery, with business activities expanding in the early months of 2025 from less than 50% in November 2024 to over 54%, according to the CBN and stanbic purchasing managers index(PMI).

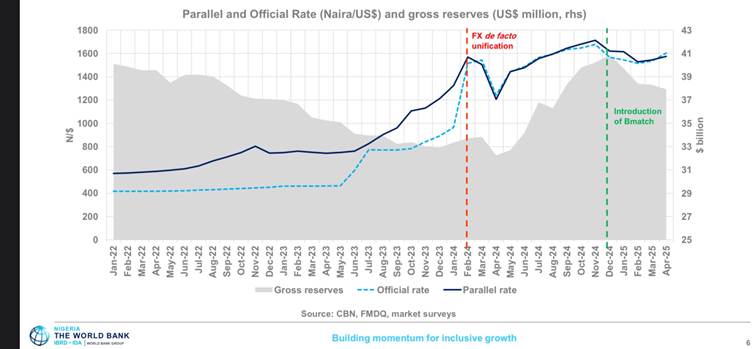

Recent reforms have also helped to strengthen the foreign exchange (FX) market and Nigeria’s external position, the NDU reported that FX reform has helped achieved “market-reflective, unified, and more stable exchange rate” and has significantly increased Nigeria’s foreign reserve buffer. Nigeria foreign reserve gross over $40billion dollars from $34 billion in February 2024, meanwhile the official exchange rate has been over 1700 Naira per U.S dollar in November 2024 but currently at 1600 Naira per U.S dollar; the NDU shows stability since the FX de facto unification in February 2024.

However gross revenue collected by the entire federation soared significantly in 2024, the NDU attributing it to factors like:

- removal of the implicit FX subsidy

- Improved tax administration

- Increased remittances from federal government owned entities (FGOEs) and ministry, departments and agencies (MDAs)

- Higher state internal generated revenue (IGR)

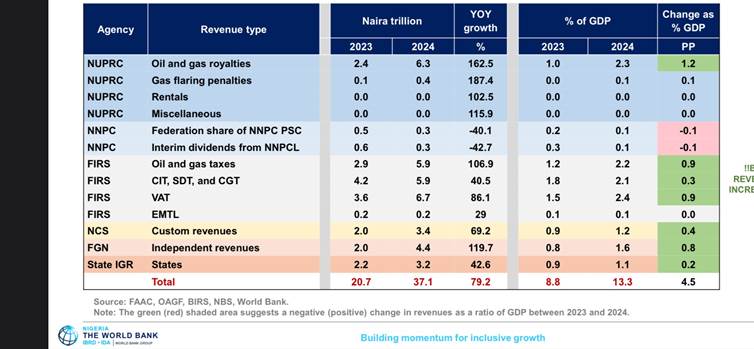

In 2023 the gross revenue collected from federal government agencies

(NUPRC,NNPC,FIRS,NCS,FGN,state IGRs) was 20.7 trillion Naira, then 2024 comes a big increase of 37.1 trillion Naira, 79.2% YOY increase. This revenues changes directly impacted Nigeria’s GDP positively as 2023 revenue collections contributed 8.8% while 2024 contributed 13.3% to the GDP with a 4.5% change in the GDP, according to NDU report.

Furthermore the NDU stated that consolidated fiscal position improved in 2024, driven by surging revenues, which was mostly seen at the state level due to revenue increase from federal account allocation committee (FAAC), 43.5 percent of gross revenue collected by the federation was sent to state accounts . The fiscal deficit shrank from 5.4% of GDP in 2023 to 3.0% of GDP in 2024, a major improvement which was driven by sharp increase in revenues of the entire Federation, which rose from N16.8 trillion in 2023 (7.2% of GDP) to an estimated N31.9 trillion in 2024 (11.5% of GDP).

Mr. Taimur Samad, Acting World Bank Country Director for Nigeria, speaking on the country’s economic development, applauded Nigeria for the impressive work being done on macroeconomic reforms stability highlighting that the country can now focus more on strategic spending on human capital and infrastructure.

“Nigeria has made impressive strides to restore macroeconomic stability. With the improvement in the fiscal situation, Nigeria now has a historic opportunity to improve the quantity and quality of development spending; investing more in human capital, social protection, and infrastructure.” He said.

Despite macroeconomic growth, challenges persist.

World Bank noted in a recent press release that, while Nigeria’s economic indicators are showing signs of improvement, particularly growth, revenue, and fiscal balance; however price pressures remains elevated. While expressing optimism about inflation rate, noting it’s expected to fall, highlighting monetary policy reforms have anchored market rates and helped contained the inflation surge.

“Inflation has remained high and sticky but is expected to fall to an annual average of 22.1% in 2025, as a sustained tight stance firmly establishes monetary policy credibility and dampens inflationary expectations.” The press release noted.

while highlightening challenges post macroeconomic reforms, world bank’s NDU report shows there have not been full transparency with the premium motor spirit (PMS) subsidy removal. It pointed out that PMS subsidy ended effectively in October 2024, but the revenue gains from the subsidy removal have not been flowing into the federation account. Also it stated that since October 2024 Nigerian National Petroleum Company Limited (NNPCL) has been using the official exchange rate for fiscal revenues, in October 2024 till December 2024 official exchange rate reached 1700 Naira per dollar but NNPCL refused to make changes during those periods and also stopped reporting FX differential losses.

However in January 2025 NNPCL began remitting 50% of the revenue gains from PMS subsidy removal to the federation; while using the remaining half to settle past arrears.

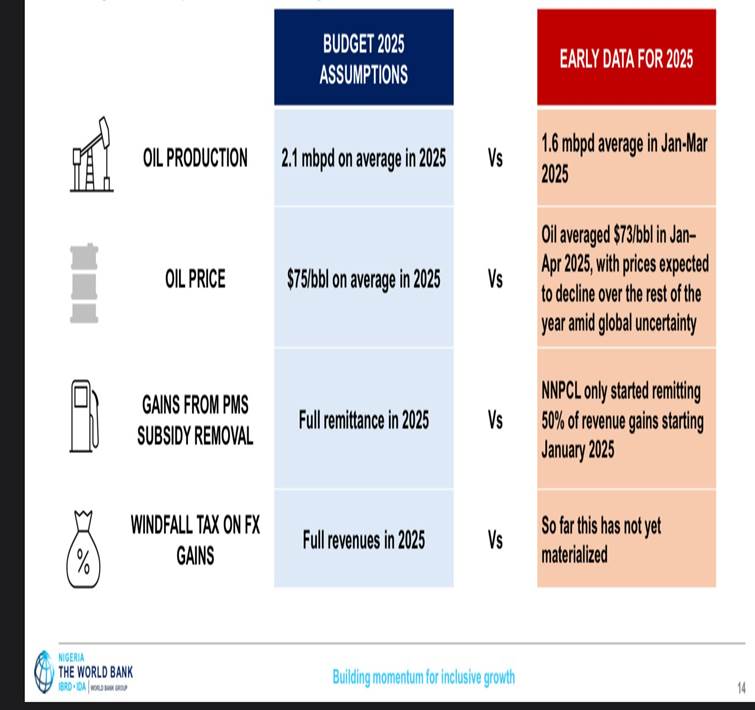

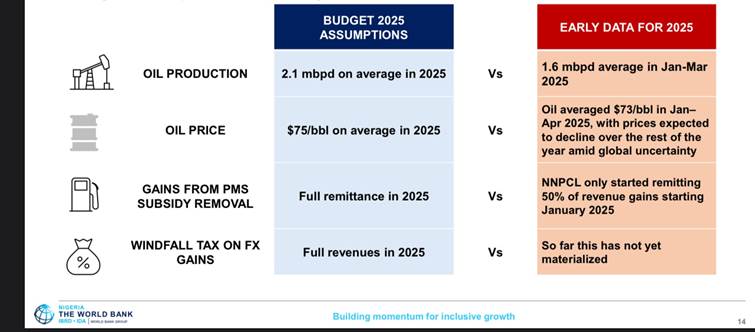

Compounding the challenges further is Nigeria 2025 national budget which the world bank’s

Nigeria development update (NDU) report has joined other financial experts to describe it as “overly ambitious” while stressing the need for its implementation to be carefully monitored and corrections be made if necessary. NDU stated that “overly optimistic revenue projections may cause financing requirements to exceed budgeted amounts, leading to a build up of arrears and raising the risk of renewed recourse to deficit monetization.” NDU emphasized that, the budget revenue assumptions and early data of 2025 appears to be grossly mismatched.

Highlighting some key differences in the budget revenue projections and early 2025 data.

Oil production 2.1 million barrels per day (mbpd) as projected in the 2025 budget but, Nigeria has only been able to produce 1.6 mbpd in January- march 2025.

Further problem associated with the oil revenue for funding of the 2025 budget is the fall in crude oil price, recently Brent crude has fallen below $60 and is currently trading above $65 but the benchmark used for the 2025 budget crude oil sale was $75 per barrel.

Following the subsidy removal and macroeconomic reforms that Nigeria has embarked on since 2023, the government has since then rolled out palliatives to help mitigate the impact of the controversial reforms, which includes 25,000 Naira cash assistance to over 60 million vulnerable Nigerians. The NDU report, stated rollout has been slow but implementation are been scaled up, it reported that as of 1st of may 2025, 5.6 million households has received atleast one time payment of 25,000 Naira, with 2.4 million and 1.24 million Nigerians receiving up-to 2-3 times the palliative, upon being biometrically verified. The authenticity of the individuals are being validated through their National identification number (NIN) or bank verification number (BVN).

Where to go from here?

However the world bank suggested some steps for Nigeria to advance macroeconomic stabilization. The NDU reported that this significant steps includes:

-monetary and FX policy -fiscal policy.

On monetary and FX policy, world bank gave the following recommendations:

World bank strongly advised that Nigeria should maintain tight monetary policy in order to lower inflation by maintaining a positive real ex-ante (the real interest rate calculated before the actual rate is revealed) policy rate, while encouraging the CBN to relying on policy rate and standard instruments rather than prudential instruments like Cash Reserve Ratio (CRR).

Uphold commitment not to monetize fiscal deficits by showing transparency in government spending. world bank recommends CBN should increase the timeliness and detail level of information on its credit to the public sector, including the ways and means advances balance and interest paid on it.

World bank also suggests improved balance sheets transparency by publishing monthly statements of assets and liabilities;

World bank strongly recommends that Nigeria maintains a unified, market- reflective exchange rate by maintaining Naira flexibility as a shock absorber and implementing while also communicating a systematic framework for FX interventions to provide clarity to market participants as to when and how CBN may buy or sell FX.

On the side of fiscal policy, world bank gave the following recommendations:

World bank strongly advised Nigeria should continue to eliminate PMS subsidy, even though reports says most Nigerians are not in support of the subsidy removal, world bank advice Nigeria to stay on course by ensuring the PMS market remains de-regularized and by strengthening antitrust measures to ensure no market player can manipulate prices.

Continue eliminating the FX subsidy, and ensure that all FX-related transactions occurs at the market- determined exchange rate.

Eliminate electricity subsidy,world bank strongly advised, while financing the electricity subsidy arrears and adopting cost-reflective electricity tariffs, and providing a universal subsidy.

NDU report shows Nigeria has not had significant progress with strengthening non-oil revenues, world bank suggests that by improving tax administration,adopting e-invoicing while strengthening tax audits,reforming the VAT regime and rationalized tax expenditures, Nigeria could strengthen its non-oil revenues.

Increase transparency for oil revenues, the NDU reported that Nigeria has not been transparent with its oil revenues suggesting that revenue gains from PMS subsidy removal should flow to the federation and a forensic audit be conducted on NNPCL.

World bank advise Nigeria to improve budget credibility by having a realistic budget assumptions and the publication of all details of the National budget in a user-friendly format for all to see and access.

Lastly on the fiscal policy key reforms, the world bank advised the government to reduce the cost of governance , NDU reports shows the government has been reckless with spending by purchasing imported cars and foreign travels, world bank cautioned the Government to desist from such reckless spending and furthermore reduce the cost of revenue collection for government agencies like the FIRs,NNPC.

Macroeconomic stabilization must be complemented by structural reforms.

The NDU further highlights that in order for the economy to meet the government’s aspiration of achieving a US$1 trillion economy by 2030 and deliver poverty reduction and shared prosperity, “macroeconomic reforms are necessary but insufficient on their own to achieve fast, sustained, and inclusive growth.” the pace of growth needs to accelerate further and its composition rebalanced towards those economic sectors and firms that are most productive, generate positive spillovers, and create jobs and opportunities at scale, especially for the poor and economically insecure. To achieve a $1 trillion economy by 2030, Nigeria needs to grow 5 times faster than it’s currently growing.

World bank called for structural reforms that’s backed by private-led, public-facilitated growth model.

Taimur Samad, Acting World Bank Country Director for Nigeria, Said it’s time for the government to start providing public services and creating an enabling environment for private sector led growth. “The allocation of public resources can begin to shift away from the past unsustainable pattern, and rather towards meeting Nigeria’s large development needs, including the government playing its essential role of providing basic public services and serving as an enabler of private sector–led growth,” Mr Taimur said.

For inclusive growth world bank structural reform suggests two key elements :

- build an empowering public sector by maintaining the current macroeconomic framework and by spending more and better on development priorities.

- Enabling private sector development, by fostering an environment for firms to grow and unleashing the potential of important sectors.

NDU report highlighted Nigeria should leverage on its upcoming, large demographic dividend by significant investment in health and education.

However in partnership with private sector, world bank said, Nigeria should improve access and quality of infrastructure to integrate markets and create more economic opportunities, expressing that large areas of Nigeria are poorly connected to economic centers and access to electricity is also low and those connected deals with frequent power outages.

Report from NDU noted it’s crucial that firms operate on a level playing field in order to foster healthy competition, while highlighting Nigeria businesses are on average, shielded against competition, resulting in many manufacturing sector being highly dominated by few players. Furthermore world bank said market-reflective Naira increases Nigeria’s competitiveness and creates opportunities to lower domestic prices and reorient trade policy towards exports.

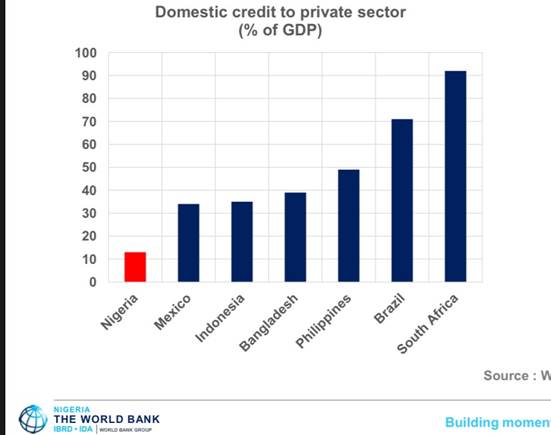

However world bank also noted credit to the private sector is very low and only few businesses have access to credit lines, emphasizing that improving access to capital is key for business to thrive. Stating Nigeria has one of the lowest domestic credit to private sector, only 11% of GDP is available for domestic credit in Nigeria, compare to South Africa over 90%, Brazil over 70% and Bangladesh over 38%.

Alex Sienaert, World Bank Lead Economist for Nigeria, stressed that the public sector can not effectively create the number of jobs needed to turn the economy around, he argued that a useful strategy is for public sector to invest significantly in human capital development.

“International experience suggests that the public sector cannot sustainably generate growth and jobs by itself. Nigeria is no exception, particularly since public resources remain constrained. A useful strategy is to position the public sector to play a dual role as a provider of essential public services, especially to build human capital and infrastructure, and as an enabler for the private sector to invest, innovate, and grow the economy,” Mr. Alex said.

NWALI CHIDOZIE MICHAEL